Investment Highlights

- Management has done a superb job at cost control and is returning cash to shareholders through the buyback

- The company’s strength in consumer products and healthcare gives it a premium on other conglomerates

- Shares are likely at least 15% overvalued, with the price surging recently on third-quarter earnings

3M Company (MMM) is a $102 billion diversified conglomerate selling primarily to the consumer and industrials market. Besides its well-known Post-it notes and Scotch tape brands, it also produces healthcare technology, adhesives, liquid crystal display films and a range of technology products. Sales outside the United States account for two-thirds of the company’s total with Asia accounting for strong growth recently.

By comparison with peer conglomerate General Electric (GE), products at 3M are focused more on consumer purchases. For this reason, the shares should be relatively less volatile and not sell-off during weak economic times.

3M suffers from the same problem seen in many other diversified conglomerate companies. The company is so large and diversified across products that it is difficult to grow any faster than the rate of the general economy. 3M does have an opportunity to take on more debt and increase its financial leverage, especially since it is able to issue debt at rates of 3% and lower.

The company has been trying to address the diversification problem by seeking a buyer for its underperforming segments. 3M announced in February that it was looking to sell components of its electronics business. The segment represents about $1 billion in sales, just 3% of total revenue.

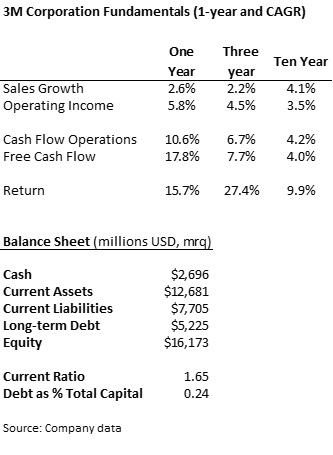

Fundamentals

Sales growth has performed in-line with the general economy, slowing in the last few years. Management has done an excellent job at controlling costs and growth in operating income has more than doubled sales growth.The shares jumped in October when 3M reported almost a 6% increase in net profits on stronger operating margins in the third quarter.

The company has an extremely healthy balance sheet with just under a third of the capital structure in debt. Current assets at 3M more than cover any near-term liabilities. Some investors may prefer the solidness of the company’s financial health. I actually think it should take on more debt to increase financial leverage and returns. 3M could easily increase its debt by another $3 billion without any liquidity problems.

Growth in cash flow has been very strong over the last year as the company cuts costs and pulls back slightly from investment spending. Management has turned its focus to returning cash to shareholders lately with an increase in buybacks and a healthy rate of dividend growth.

Dividends and Growth

Shares of 3M pay a decent 2.2% dividend yield, lower than the 2.4% five-year average but still higher than the market’s yield. The company’s payout ratio of 44% is slightly higher than the five-year average of 39% but is still fairly low for a mature company.

Dividends have grown at a strong 9.9% rate over the last five years, supported by a sizeable buyback program. 3M is one of the oldest in the S&P Dividend Aristocrats, paying a dividend since 1916 and increasing payouts for 55 consecutive years.

Besides paying out a respectable yield, 3M consistently buys back its own shares as well. The company bought back $6.0 billion in shares over the last four quarters, more than twice as much as was spent on the dividend.

Valuation

Like many of the companies we’ve looked at recently, valuation is where the argument for 3M starts to break down. Shares of 3M are trading at 21.8 times trailing earnings, slightly above the industry average of 19.8 times and well above the company’s five-year average of 16.6 times earnings. While the shares trade just 10% above the industry average, that does not necessarily mean that the industry is not fairly expensive as well.

With the stock market at record levels, the whole group of conglomerates could be overvalued. The current price-earnings ratio for 3M is more than 30% above its own 5-year average.

It is also hard to justify the stock price on a discounted cash flow approach. I am assuming a cost of capital of 5.8%, which is probably a little low considering the direction of interest rates, and an assumption of 9% dividend growth going forward. While the company has managed to grow the dividend by 10% over the last five years, it would be hard to do this into perpetuity especially given the company’s size and limits on growth.

With even these fairly aggressive assumptions on dividend growth and capital costs, the fair value of the shares is $132.02 each and overvalued by 17% on the current price.

I like 3M for its diversified product line, especially its strong brands in consumer items and its strength in the growing healthcare field. A renewed focus on share repurchases is putting a lot of money back in investors’ pockets and the company could increase growth by taking on slightly more debt. At the current price, even with these positives, it is hard to justify buying the shares. I would want to wait until the stock came down to at least $140 per share which would mean a 2.5% yield and a value closer to the company’s long-term prospects.