Shares of toy-maker Mattel (MAT) have done poorly over the last year as growth in developed markets slows and the company fails to capitalize on entertainment crossovers. After a 16% two-day dive in January, the shares are attractively priced relative to peers and growth may be around the corner with a recent acquisition.

Investment Highlights

- Growth in emerging markets is still strong as a growing middle-class starts buying toys

- Recent acquisition of Mega Brands could open the door to broader commercialization of brands

- A strong balance sheet and sustainable dividend with shares slightly undervalued

Overview

As the largest toy company at $13.1 billion, Mattel commands huge economies of scale and scope within the industry. The company controls 17% of the U.S. toy market and sells some of the most recognized brands like Barbie, Hot Wheels and Fisher Price.

Mattel operates in three segments: North America, International and American Girl. Besides manufacturing and marketing toys, it also publishes books and activity games.

The primary risk to Mattel is the risk of substitutes for toys, primarily from electronics. Children are increasingly aging out of traditional toys at an earlier age and adopting electronic goods like tablets and smartphones. The company is acquiring growth in electronics but may find competition more difficult than in its traditional toy category.

The company books 40% of its revenue from three sources: Toys ‘R’ Us, Walmart (WMT) and Target (TGT). This could mean that the company will need to give higher pricing concessions and terms than another company with a more diversified base of buyers.

Mattel has not seen the entertainment contracts that have benefited rival Hasbro (HAS) but that could change with the recently announced Barbie movie with Sony. It could be a while before the live-action movie comes out but could help to support sentiment in the shares.

Fundamentals

Sales have grown by 3.4% annually over the last three years while a program to control expenses has contributed to an impressive 8.9% annual increase in operating income. This has helped the company double its operating margin over the last five years to 18.0%, well above a margin of 13.0% at Hasbro.

The company had $1.0 billion in cash as of the end of the last quarter though $460 million will go to its recently announced acquisition of Mega Brands. Even after the acquisition, cash of $570 million is adequate against current liabilities of just over $1.0 billion. Long-term debt has been relatively consistent around $1.6 billion and accounts for 33% of the company’s capital structure.

The company covered its interest expense with earnings by more than 11 times last year so could probably use a little more leverage in its finances. Hasbro uses 45% debt in its capital structure and only covers its interest expense by 2.7 times.

Dividends and Growth

Mattel shares pay a current yield of 4.1%, above its 3.4% five-year average. The payout ratio of 57% is also slightly above its 54% average over the last five years. This may mean that dividend growth will slow to allow fundamentals to catch up to the long-term average or that management has made the decision to increase cash return to shareholders.

Either way, the company made a strong commitment to returning shareholder cash. Mattel has bought back a total of $1.08 billion over the last three years and has paid out $1.23 billion in dividends. In 2013 alone, more than $987 million was returned to shareholders which accounts for more than 7% of the company.

The shares have paid a dividend since 1990 with four years of consecutive increases. The dividend per share has grown by an annualized 15.6% over the last five-years though growth has slowed to 10.7% over the last two years.

Valuation

Shares trade for 14.6 times trailing earnings, just below the five-year average of 14.9 times earnings and well under the 22.6 times valuation on shares of Hasbro. On earnings of $2.81 per share expected in 2015, the shares would be worth $41.03 along with the steady dividend.

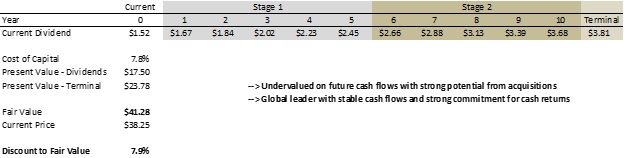

The discounted cash flow analysis below confirms a fair value around $41 per share. I used a conservative estimate of 10% growth for the first period, followed by growth of 8.5% in the remaining five years. Terminal growth of 3.5% should be easily achievable and will probably prove overly conservative.

The company’s 10-year debt pays 4.5% and leverage could probably be increased a bit for higher returns. Even on these conservative estimates, the shares are undervalued by nearly 8% and pay a sustainable dividend.

Besides solid fundamentals, Mattel could be setting up for strong cash flows with its acquisition of Mega Brands. The company holds the licenses to a list of brands that could be leveraged further into entertainment like HALO, Call of Duty, Power Rangers and SpongeBob Square Pants. If Mattel were able to commercialize its brands as peers have been able to do, the shares could do significantly better than the forecasts above.

Having young kids I can attest to how this business will have a hard time going out of business. During the next correction I plan to take a nice long look at Mattel

I grabbed shares of Hasbro awhile back when they were trading at a really low valuation. No one was interested in the standard old toy makers because apparently kids were only interested in video games and high tech toys. But you can’t tell me that parents aren’t still buying barbies, legos, GI Joe’s, board games and what not for their kids.

I’ve been a happy owner of Hasbro over the past few years and I’d love to add some Mattel to my portfolio. It looks to be a decent valuation now and may be a good time to pick up some shares to accompany my Hasbro shares. Then I can be the proud owner of two toy companies!

Thanks for the analysis. I’ve been investing a little in HAS but it is hard to pick a winner between HAS and MAT.