Investment Highlights

- Even on limited use of debt, the company is still able to produce returns higher than others in its industry and should continue to do well even if oil prices fall

- Resuming operations in Russia are key to meeting the company’s production goals. Wait for management guidance on the third-quarter results for any new buying

- The shares are fairly valued but can still provide a long-term return of around 8% annually given stock buybacks

Exxon Mobil (XOM) is the world’s largest integrated oil company with operations in more than 200 companies. The company sees most of its revenue from exploration and production (79% of 2013 sales) though it also books 11% of sales from chemicals manufacturing and 10% from refining.

Management expects production to come in around 4.0 million barrels of oil equivalent per day this year, basically flat from last year, but to increase to 4.3 million BOE/d by 2017. While revenue from refining and chemicals offers some diversification, the company is really a production play and depends on continuous investments in exploration to drive sales.

Just days after the company said it had made a major discovery in the Kara Sea region of the Arctic Ocean with joint-partner Rosneft, Exxon suspended cooperation with the Russian state-owned company due to sanctions. The U.S. State Department had earlier granted a short extension to wind down rig operations. The well drilled in the area found nearly one billion barrels and similar geology nearby that would likely hold more.

Exxon is hoping that the situation in Ukraine can be resolved and sanctions will be lifted before production would begin in the Arctic region. It is likely that this will happen since production could be more than a year away but the even still represents a risk for the company. Oil production at Exxon has dropped for the last two consecutive years and is expected flat this year. Russian drilling rights, at 11.4 million acres, are the largest outside of the United States (15.1 million acres) and the company is depending on increased Russian production to lift sales.

The company recently announced that it is delaying drilling plans for its offshore blocks in Liberia due to the outbreak of Ebola in West Africa. The site was originally scheduled to start operations late this year but will likely not start until 2015. The effect on production will be negligible though and will not affect the company’s value.

Fundamentals

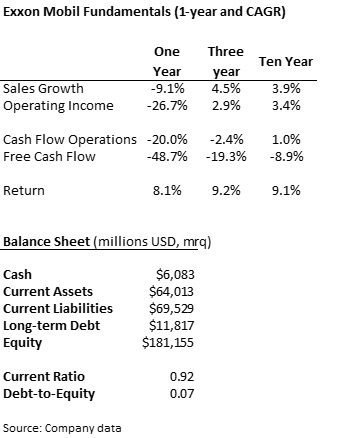

Sales growth slipped in 2013 but has picked up a little so far this year. The company has not done a very good job managing operational expenses though and operating income has fallen dramatically. This seems to be a problem over the last few years but not as much over the longer-term with growth in sales and operating income relatively similar.

Despite the fact that the company carries fewer current assets than its current liabilities, there is no danger of Exxon running into problems paying for near-term expenses. I was surprised to see that the company only holds a small amount of debt, just 10.7% of its capital structure. Interest rates on the company’s bonds are extremely low, less than half a percent more than U.S. Treasuries, and returns could be boosted significantly with a little more financial leverage. Despite the weak use of leverage, Exxon still has one of the highest returns on equity in the industry with an ROE of 19.6%.

Cash flow from operations has been hit along with the drop in sales but has rebounded significantly this year. Even with the drop in sales, the company has maintained its high level of investment spending ($33 billion annually) so sales growth should at least stabilize if not pick up from here. Free cash flow fell off a cliff in 2013 but has since rebounded 38% over the last four quarters.

Dividends and Growth

Exxon offers the 12th highest dividend yield of the 54 S&P Dividend Aristocrats with a 3.0% yield, slightly higher than its 2.6% average yield over the last five years. The company has increased its payout to 34% against a five-year average of 28% but still retains plenty of funds for investment in growth projects.

Management has increased the dividend by an annual rate of 10% over the last five years and has grown the payment for 31 consecutive years. Exxon is one of the oldest companies to pay a dividend with payments stretching back to 1882.

Exxon has slowly reduced the amount of its share repurchases over the last couple of years but still returns a significant amount of cash to shareholders. The company repurchased $13.2 billion in shares over the last four quarters, lower than the $16 billion repurchased in 2013 and $21 billion repurchased in 2012. Along with the dividend, the company has returned $24.7 billion to investors over the last year for a 6% total yield on the current market capitalization.

Valuation

Shares of Exxon trade just slightly more expensively than peers with a price multiple of 12.0 times earnings against an industry average of 11.4 times earnings. The current multiple is still below the company’s own five-year average of 12.3 times earnings so the shares may not be too expensive relative to historical data.

On a discounted cash flow approach, shares are trading right around fair value. This is based on a growth rate of 10% in dividends and a cost of capital of 6.5% for the company. While I think management could lower the cost of capital by increasing the use of debt, and increasing the fair value of the shares, the dividend growth rate is likely about as much as can be expected.

The setback to the partnership with Rosneft in Russia is the one factor that keeps me worried for an otherwise excellent dividend stock. It is really difficult for a company of Exxon’s size to continuously increase production and it needs production in Russia to meet its goals. The company will report third-quarter earnings at the end of October where management is likely to talk about Russia and give more guidance. I would hold off on committing too much new money to the shares until then. Long-term investors should continue to enjoy a strong dividend yield and good appreciation in the share price.

Thanks for the XOM article. I’m a buyer of XOM, as I’m slowly building my position. I just bought some last week during the latest market dip. I’m hoping the price stays fair for the rest of the year and I can continue buying.

I also just bought XOM. I was hoping to buy sub-$90 but im just getting started and it took a couple of days for my funds to clear. Despite Russia, it should be fine.