Investment Highlights

- Shares have been weak this year on slow economic growth in Europe and have recently been hit on lower oil prices

- Management has stuck with its commitment for shareholder cash return, increasing the dividend and buying back shares over the last year

- Lower oil prices could continue to hit the stock price but a strong long-term outlook present an opportunity to pick up the shares

Emerson Electric (NYSE: EMR) is one of the largest suppliers of electronic controls and technology to industrial, commercial and consumer markets.

The process management segment provides equipment and controls to industrial companies and accounted for 36% of this year’s sales. The company has already seen weak sales and a lower stock price this year on poor economic growth in Europe, now shares are getting hit on lower oil prices. If energy prices remain low for an extended period, production companies will need to reduce capital spending which would reduce demand for electronic controls and equipment.

Earnings for 2014 were mixed with strong demand for energy-efficient infrastructure but held back by the slow recovery in Europe. The company wrote down the value of its Chloride business, acquired in 2010, by $508 million on reduced expectations for network power.

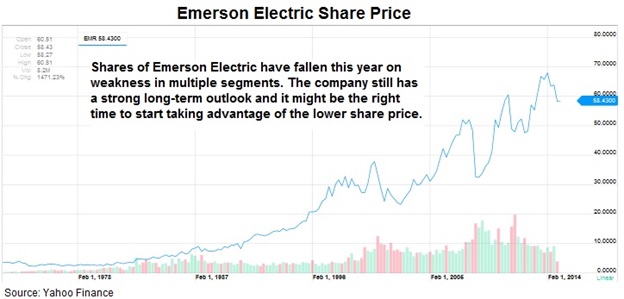

Despite the recent weakness in several segments and the share price, you only have to look at a long-term chart to wonder if now might be a good time to take advantage of lower prices.

Fundamentals

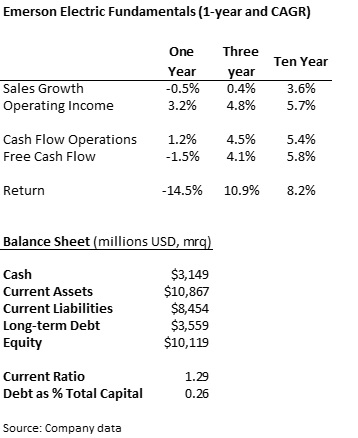

Sales fell by half a percent in 2014 but the company was able to increase operating income through cost controls. As a relatively mature company, sales growth should track closely with general economic growth.

The company is in good financial health with about a quarter of its capital structure in debt and enough current assets to cover near-term liabilities. The company issued $3.1 billion in debt over the last year to pay off $2.8 billion in maturities and improve its cash position. The bright side of industrials weakness is that the company is strong enough to weather the storm while smaller competitors may fail. This would present a positive long-term opportunity for market share.

Cash flow has followed sales lower over the last year but should not be a problem. Free cash flow fell by $46 million due to an $89 million increase in investment spending. Despite lower sales, the company was still able to increase earnings and operational cash flow.

Even on the decline in the stock price this year, the shares have provided a good return over the last decade.

Dividends and Growth

Shares pay an attractive 3.2%, above the 2.8% five-year average but partly due to the drop in the stock price this year. The payout ratio has increased slightly to 58% from the 55% average over the past five years.

Emerson Electric has made a strong commitment to shareholder cash return, increasing the dividend by an annual rate of 5.9% over the last five years. Dividends have been increased for 19 consecutive years and have been paid since 1947.

The company has also been a consistent buyer of its own shares, repurchasing more than $1 billion in shares over each of the last two years. Between the dividend and buyback, the company has returned more than $2.3 billion to shareholders over the last year.

Valuation

Shares trade for 15.5 times earnings of $3.77 over the last year, well under the industry average of 19.1 times earnings. Analysts expect earnings to increase by 5.6% next year to $3.98 per share on 1% growth in sales. Meeting sales and earnings expectations might be difficult if the oil & gas industry does not rebound on higher oil prices.

Discounting the future dividends and cash flows puts the shares closer to fair value. For my analysis, I assumed that dividend growth may slow to 5% over the next two years as the industrial segment struggles with a weaker environment for investment spending by oil companies. In year three through ten, I assumed that dividend growth returned to a 7% annual rate before settling at 4.5% into perpetuity. At a cost of capital of 6% the stock is worth $55.46 per share, about 5% below its current price. There are a lot of estimates in a fair value estimate and I wouldn’t be concerned about a valuation within 5% of the current price.

Analysts will be watching fourth quarter earnings announcements by oil companies to get an idea of how much they will be spending on capital investment next year. Lower spending could hit investor sentiment for equipment suppliers like Emerson Electric. I like the company’s high dividend yield and long-term outlook but would be a little wary of putting too much into the stock before earnings early next year. Consider investing half of your planned amount in shares now and the other half late February after most companies have reported earnings.