Investment Highlights

- New management has been successful in cutting costs and restructuring the company with further improvement likely to come

- The company holds a dominant position in a mature industry, allowing it to generate good cash flows and return money to shareholders

- Despite the outlook for better profitability, shares are very overvalued and may need to pull back as much as 20% to return to fair value

Air Products & Chemicals (NYSE: APD) is the world’s largest supplier of hydrogen and helium, operating in 40 countries and booking 60% of its sales outside the United States. The company owns the only major hydrogen pipeline supply to Canadian oil sands and supplies hydrogen to 90% of U.S. gulf coast refineries.

Long-term contracts to supply industrial gas for production mean revenue is fairly stable and easy to forecast. Air Products controls 40% of the global hydrogen market, twice as much as the nearest competitor, and has built a strong presence in the Chinese market. This supports a strong outlook but management inefficiencies have plagued the company over the last several years.

Activist investor Bill Ackman and his firm Pershing Square holds nearly 10% of the shares and pushed for a new CEO earlier this year. Seifi Ghasemi, a board member since 2013 and former CEO of Rockwood Holdings (NYSE: ROC), was named as the new CEO in June.

The new CEO has been successful in controlling costs through the company’s restructuring. Excluding an impairment write-down, operating margins improved in fiscal 2014 and the company grew operating profits by 12% on growth of just 2% in sales. Shares are up more than 36% over the last year on investor hopes that the new CEO can drive further efficiencies.

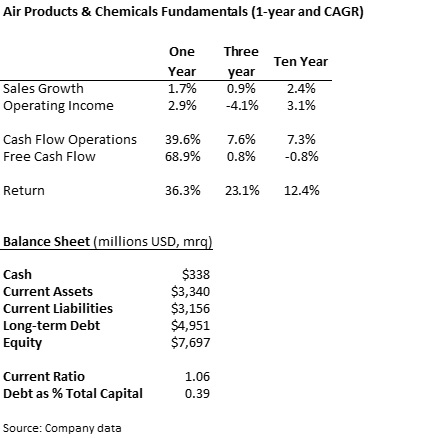

Fundamentals

As a fairly diversified player in a mature market, sales growth is closely tied to the pace of economic growth in the United States and globally. The company is in the middle of a restructuring effort, selling underperforming segments and cutting costs to drive higher profits. The turnaround looks like it is just beginning to pay off with growth in operational income rebounding to its long-term trend. Operational income over the last year was hit by restructuring costs but should improve over the next several quarters.

The company has worked to pay down over the last few quarters but financial leverage is still fairly high at about 44% of the total capital structure. Just over $374 million in debt is due March of 2015 though the company should have no trouble refinancing. While there is really no threat to liquidity, high debt and a marginal sales outlook could limit cash return to shareholders over the next couple of years.

Reported cash flow has been volatile over the last couple of years due to non-cash items like deferred taxes payable and some one-time items from asset impairments on the restructuring. Instead of looking relying on recent data, investors may want to look at the longer trend over three- and ten-years.

Dividends and Growth

Shares of Air Products just barely meet my yield cutoff at 2.1%, slightly lower than the 2.5% average over the last five years. The payout ratio has jumped to 63% on restructuring costs and other one-time items but should come down to its longer-term average of 50% over the last five years.

Despite transitional hurdles with the restructuring, the company has been able to grow the dividend by an annualized 11% for five years and has increased the payout for 31 consecutive years.

The company has been an aggressive buyer of its own shares in the past, returning $462 million to shareholders in 2013 but has not repurchased shares in the last year. Normally, I would expect success in the turnaround program to lead a buyback in shares and management’s vote of confidence in the future. Low cash on hand and a high stock price make me think that this might not happen for Air Products though it should be able to continue its pace with dividend growth.

Valuation

For all the positives on shares of Air Products & Chemicals, the stock is extremely expensive at 25.0 times trailing earnings. The price multiple is more than 29% above the company’s five-year average of 19.3 times and well above the industry average of 17.2 times earnings.

Analysts expect earnings to increase by more than 11% over the next two years on sales growth of 4.8% in 2015 and 5.8% in the following year. To meet these expectations, not only will the company need to almost double its long-term rate of sales growth but it will need to improve its net margin by 1.5% over the period. None of this would be outside the realm of reason, but it will be a tough accomplishment and would still leave the shares valued around their five-year price-earnings average.

On a discounted cash flow basis, the company would need to increase dividends by a compound annual rate of about 12.5% into perpetuity to be fairly valued around the current price. If we instead assume an 11% dividend growth rate over the next five years, leveling off to a 9.5% rate after that, the shares would be fairly valued around $115 each. That is about 20% lower than the current price and would confirm the longer-term average price-earnings multiple.

Air Products seems to be heading in the right direction operationally and earnings should improve over the next year. Against this optimism, the shares have surged and I just can’t justify recommending them at the current price. I like the stability in the sales growth and the company’s dominating control in hydrogen supply to refineries but the shares are just too expensive. While you may not want to wait for a major pullback, I would wait for the stock to come down to at least $120 per share or a price-earnings ratio around 20 times.