I published a call on energy stocks in early April, highlighting the sector as a rare buying opportunity on the 50% drop in oil prices. The price of oil looked like it was stabilizing and long-term fundamentals pointed to strong returns on top of higher yield.

Oil prices continued higher, shooting up 22% to May from when the article was published, taking the stock picks up with it. I hate the constant market push to ‘time’ stocks and would never tell investors to jump in or out of stocks, trying to find a market bottom.

But it’s pretty nice when a long-term call is quickly followed by a jump in prices.

Of course, that was before late June and a return of lower oil prices. A stronger dollar on Fed rate talk has driven the price of oil 2.5% lower than where it was in early April. All three stocks I mentioned in my April article are now down more than ten percent.

Is it time for energy investors to start getting worried? Or is now a rare opportunity to buy more?

The Problem with Cheap Energy Stocks

If you can handle a little volatility and risk, there has never been a better opportunity to increase your dividend position in energy but that doesn’t mean there are not problems.

If you’re wondering why oil production has not crashed as fast as the rig count, look no further than hedging contracts. Shale drillers booked up to 65% of their first quarter revenue from price hedges set before last year’s price collapse. Most of these hedges will be expiring towards 2016 and revenue is likely to continue lower for the exploration & production segment. Production should start to come down over the next several months which should support energy prices but there could be more pain on the way.

Massive debt loads are the second major overhang for energy stocks, especially in the upstream explorers and midstream transportation. Debt flowed freely up until last year to pay for massive mergers and investment spending to capitalize on America’s energy revolution. That revolution is still alive and well but the drop in prices has called into question the short-term ability to pay for many companies.

One Reason Why Energy is your Best Buy Now

I could reiterate my fundamental reasons for buying energy from the April article but I recently found one that easily trumps them. The long-term outlook on macroeconomic forces is still strong for the sector and America is still set to be a huge beneficiary of its new oil boom.

But looking at the dividend on the Energy Select Sector SPDR ETF (NYSE: XLE) just gave me all the reason I need.

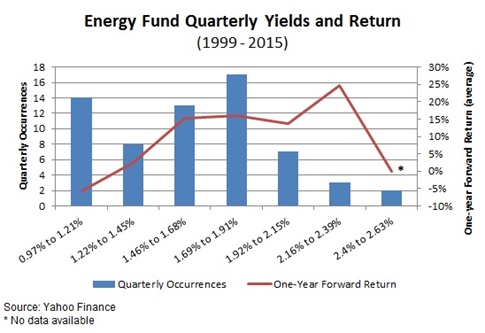

The energy fund has paid 64 quarterly dividends since March of 1999. If we look at the trailing yield at each dividend payment, we find an average yield of 1.6% against the 2.6% annual yield paid in June. In fact, the most recent trailing yield is the highest ever recorded for the fund.

The graphic shows occurrence of trailing annual yields over the 16 years and the average return on the fund over the subsequent year. Yield was found by adding the most recent four dividend payments on each payment date and dividing by the closing price on that day. The one-year forward return is the average return for the years in each range group.

The dividend yield has held to a range of between 1.46% and 1.91% for most of the period. Most (10 of 14) of the lowest yield occurrences were in the few years before the 2008 stock market crash when oil prices zoomed to $140 a barrel.

The forward return generally increases as the dividend yield increases, as would be expected if we assume the higher yields were after a slump in the share price. The only two times the yield has been above 2.4% has been in March and June of this year.

I’ll be the first to admit that names in oil & gas still may have a tough year ahead of them. The U.S. dollar and Fed rate jitters has hit the price of oil along with booming production. Price hedging will add less to producer’s revenue and many in the industry are overburdened with debt.

The energy ETF is the safest play with its risk spread among 41 companies from upstream exploration to downstream marketing. Even if we do not see a bottom in energy stocks for the next several months, long-term fundamentals persist and investors are getting an historic yield while they wait. My April call for optimism will take longer to play out but adding to your dividend positions in energy could turn out to be one of your best investments.