Realty Income Investment Highlights

• Strong commitment to shareholder cash return with 545 consecutive monthly dividends and more than 20 years of increasing payouts

• Rising interest rates and a long-term trend to online shopping may weigh on profits but the company is repositioning to protect growth

• Shares currently a discount of about 7% on five-year average valuation

Realty Income (NYSE: O) is one of the largest real estate investment trusts (REITs) with 4,400 properties. Most locations are freestanding, single-tenant and contracted on a triple-net lease where the tenant pays all expenses and maintenance. This reduces the management cost and risk around the property but also reduces rent yield.

Realty Income owns property in 49 states and Puerto Rico. Most states account for less than 5% of rental revenue though California (9.9%) and Texas (9.1%) together are nearly a fifth of revenue.

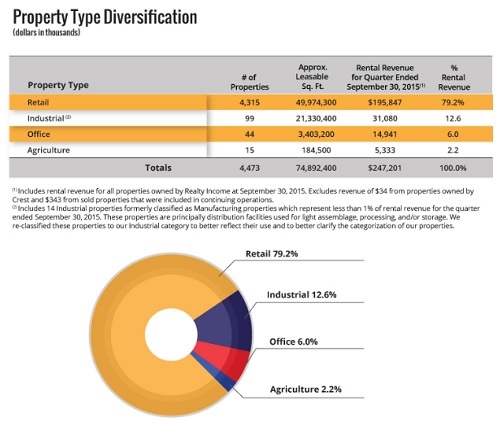

While the company has traditionally held retail properties, it has started to diversify over the last few years. This is in response to the trend from brick-and-mortar retail into the online space and should help protect sales growth in the future. While 80% of revenue comes from retail, many of the retail base is with large, established retailers that should be able to pay rents even as more shopping goes online. Nearly half (49%) of retail customers are from industries that are relatively protected from online shopping like convenience & drug, fitness centers, restaurants and dollar stores.

The company is slightly exposed to client-specific risks, as are most REITs. Two tenants account for more than 5% of revenue, Walgreens (7%) and FedEx (5.2%), and the top 10 tenants account for 38% of revenue. All the largest tenants are large companies with relatively stable financials but some risk remains. Investors can reduce this risk by investing in at least one other REIT focusing on different property types.

The big question mark lately has been the effect of rising rates on REITs. The special real estate holding companies pay out more than 90% of income each year in exchange for a pass on corporate income taxes. This means that new acquisitions and development must be funded with a continuous stream of debt and equity issues. Rising interest rates means debt becomes more expensive to issue and the company may need to issue more shares which are dilutive to current shareholders.

In fact, the market’s reaction to higher rates is clear looking at a chart of Realty Income (blue line) and the yield on the 10-year Treasury (red). Every time the rate on Treasuries went up over the last year, shares of Realty Income and other REITs took a hit.

But the argument breaks down over longer periods. Rates on the Treasury bond have fallen from 6% in 2000 while shares of Realty Income have returned an annualized 18.4% over the period. Rising interest rates normally coincide with positive economic growth and employment, both good factors for strength in shares of REITs. Market jitters over rising rates will weigh on REITs and Realty Income but it’s largely a temporary pressure.

Realty Income acquired 195 properties this year and has been able to lease them all with an average term of 17 years, well above the average lease term across all properties of 10 years. The company is able to manage an overall occupancy rate of 98.3% by offering attractive rents on long-term leases to large and stable retailers.

Realty Income Stock Fundamentals

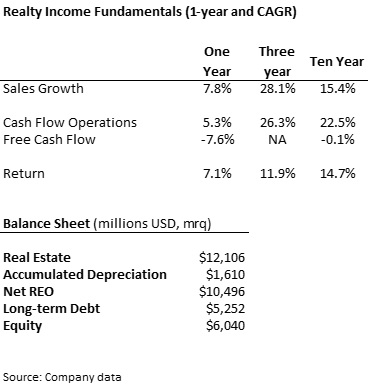

Sales growth has slowed a little though deal spending has doubled to $1.2 billion a year and should support faster revenue growth over the next few years. The increase in investment spending has hit free cash flow growth but growth in operational cash flow is a better measure of overall growth.

The balance sheet of REITs is different from most other companies. Property accounts for almost all assets and the companies keep very little cash on-hand. Debt levels tend to be fairly high and maturities are short-term. REITs pay higher rates on debt so usually issue bonds at ten years or less. Realty Income finances half its capital structure with debt and has an average of $262 million in maturities over the next four years. This is manageable and the company shouldn’t run into any liquidity problems.

Realty Income Dividend and Growth

The dividend yield of 4.6% is just under the average of 4.9% over the last five years. To give you an idea of management’s commitment to cash return, Realty Income has trademarked the tagline, The Monthly Dividend Company.

Realty Income recently announced its 545th consecutive monthly dividend over 46 years of payouts. The dividend has increased 82 times since the company went public in 1994 and is one of the few REITs to pay dividends on a monthly basis. Dividends have increased an average of 6% annually over the last five years.

Realty Income Valuation

The traditional PE ratio means nothing for a REIT because it doesn’t account for the amount of depreciation that is taken each quarter. Instead, REIT investors use funds from operations (FFO) as a measure of income and value. FFO adds back depreciation expense and removes any one-time gains from the sale of property.

Realty Income is trading for approximately 17 times FFO, a discount of 7% on its five-year average of 18.3 times FFO. The company’s FFO per share grew at an annualized 9% to $2.58 per share over the four years to 2014. It’s not particularly cheap but isn’t expensive either and the dividend is well-covered. Of the 13% annualized return over the last decade, approximately 8.5% has been from price appreciation.

Realty Income is a great stock for smoothing your monthly income and the dividend is likely to grow steadily for years to come. Dual headwinds of higher interest rates and a gradual trend to online retail may mean that total return comes down slightly but investors should still be able to count on a return that matches or beats the general stock market.

Big “O” is a great one. I love monthly payers now that I’m in FIRE. It sure makes budgeting easier. That’s a large part of why I’m so high on the closed end municipal bond funds.

I’m a big fan of O and monthly dividends. At my current shares I get close to one full share a month through DRIP. 12 shares a year bought with dividends. It adds up fast. Let’s hope the stock stays strong. Lately, O has been on a great run.

I love these monthly paying dividend growth stocks, I wish there were more like Realty Income. Actually their motto is “The Monthly Dividend Company”. I’m guessing that many of their investors are retired, since they need the income every day.