Monsanto Investment Highlights

• Excellent long-term outlook with global food demand virtually guaranteeing a market for the company’s GM seed line

• Best of Breed position with #1 or #2 market share in five core markets

• Strong cash flow generation and plans for shareholder cash return as part of major cost-saving restructuring

I’ve never been a fan of market timing or thinking I could ‘beat’ the market buy jumping in and out of stocks. The long game has always worked best for me, picking quality companies that will put cash in my pocket and grow their share price.

But every once in a while, the market goes into one of its moods and sells off a sector without really thinking about it. Sales for an industry take a tumble or prices get hit for some reason and the market looks at it like it’s the end of the world.

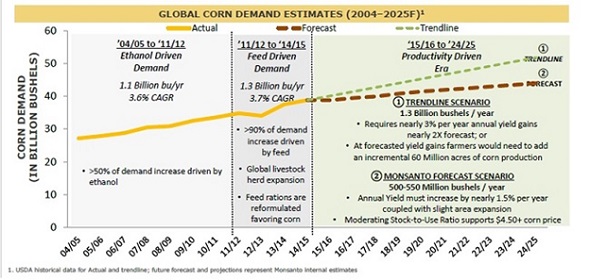

But some sectors are just prone to big cyclical swings. Agricultural commodities are the best example with booms and busts so frequent you could set your watch by them. Corn prices have peaked six times in the last 100 years only to come crashing down as the supply and demand picture changes. Just recently corn prices peaked at $8.54 per bushel in 2012 only to plunge 54% to under $4 this month.

The selloff in grain prices has taken the entire sector down with it but does anyone really believe that ag prices won’t go zooming higher eventually? Research shows that crop yields aren’t sufficient to feed the world’s booming population. Global grain supply needs to double by 2050 to meet food demand and the average yearly increase in crop yields of 1.2% is half of the yield growth to get there. The deficit in corn alone could be as much as 100 million tons per year by 2025.

Monsanto (NYSE: MON) is the best positioned to take advantage of the eventual rebound in crop prices and the long-term demand for grains. The company created the genetically-modified crop market and made the decision early to license its seed traits to competitors. This has led to an almost universal adoption of the company’s GM business with 90% of soybeans and 80% of corn in the U.S. carrying a Monsanto trait. Besides a huge stream of licensing revenue, it also helps to drive sales of the company’s Roundup line of weed killer which can be used on crops that contain a special trait to protect them from the chemicals.

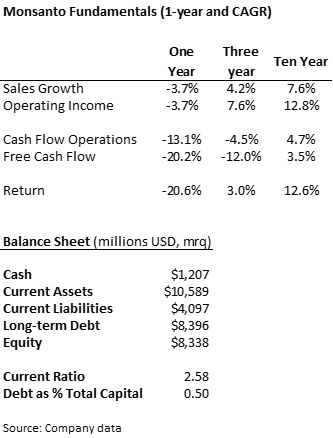

The $41 billion biotech agricultural giant holds a #1 or #2 market share in its five largest markets. The shares have come down 30% off the 52-week high but have still managed to produce a 12.6% annualized return over the last decade.

Besides the general selloff in crop prices, Monsanto has seen its sales hit by the stronger dollar. A stronger dollar means foreign sales are not worth as much when converted into the greenback for reporting and the company has booked a year-over-year decline in sales three of the last five quarters.

But against this cyclical weakness, Monsanto management is making the tough decisions to protect cash flow and plan for the future. The company recently announced a restructuring to cut labor costs by 12% and result in $575 million in annual savings over the next two years.

Current plans are based on a modified forecast for corn demand and crop prices, one that could prove to be extremely conservative when the market returns to its long-term trend.

Monsanto Stock Fundamentals

Sales have weakened over the last year but the company has managed to cut costs in-line with revenue. Costs on the new restructuring plan will hit results over the next few quarters but operating margin should start to rebound significantly by mid-2016.

Monsanto is one of the more leveraged companies in its industry with half the capital structure in debt. The company has managed current liabilities well and there is no threat to liquidity. Bonds carry an A-rating by Morningstar and debt maturities are spread fairly evenly through 2025.

Monsanto maintains its innovation lead by spending more than $1 billion a year in research & development. The drop in cash flow from operations has been amplified for a larger drop in free cash flow without cuts to capital spending. Even in the current weakness, the company has managed to generate $1.6 billion in free cash flow over the last four quarters.

Monsanto Dividend and Growth

The plunge in shares has improved the dividend yield to 2.4% from an average yield of 1.7% over the last five years. The payout ratio has remained steady at 36% but may need to be increased to maintain regular dividend increases which have grown at a rate of 13.4% over the last five years.

Monsanto has paid a dividend since 2001 and has increased its payout for 13 consecutive years. Management has taken advantage of lower prices to aggressively buy back shares, repurchasing $6.8 billion over the last four quarters. As part of the restructuring plan, the company will accelerate its share buyback program with another $3 billion repurchased over the next six months.

Monsanto Stock Valuation

After the selloff on the share price, Monsanto is trading at just 16.1 times trailing earnings and well below its five-year average multiple of 24.9 times earnings. Analysts expect reduced earnings this year of $5.38 per share before rebounding next year to $6.48 per share.

The grain market may take a couple of years to rebound but Monsanto doesn’t need another boom cycle to turn its shares around. The company is on track to release its next generation of Roundup Xtend system next year and profitability should improve by the middle of the year. The company still generates strong cash flow and is planning on returning a lot of that cash to investors.

I’m not quite as optimistic on next year’s earnings but even at $6 per share, the stock price comes down to less than 15 times earnings. The aggressive restructuring plan, share repurchase and long-term demand makes it easy to like shares for a buy recommendation.

I also really like DuPont (DD) in the GMO space. They have more diversified revenue, great patents, and are trading at a very attractive valuation.

Very nice write up on Monsanto. The company certainly has a strong competitive advantage and is shareholder friendly.