Investing Highlights

- Shares of BP offer one of the highest cash returns among the major integrated oil companies

- 2015 earnings are expected much lower but could surprise higher on cost cutting programs

- The long-term demand story for energy is intact and the recent selloff offers a good opportunity for long-term share price appreciation on top of the regular dividend

The long-term outlook for oil and energy demand is in stark contrast to the short-term panic selling by many energy investors over the past few months. British Petroleum (NYSE: BP) offers one of the highest dividend yields among the major integrated players and is in no danger even if oil prices stay low for a while.

The dramatic selloff in oil prices has been the top theme in the financial news for months so I won’t bore you with rehashing the story. The price of West Texas Intermediate has halved just since late last year after OPEC said it would not cut production to support prices. What has been missing from the daily analysis is the long-term story and what really hasn’t changed for the sector.

The IMF downgraded its 2015 outlook for global economic growth but still sees 3.5% this year, an increase from 3.3% in 2014. Cheaper oil will drive economic growth in the largest economies like China, the United States and the European Union. With strong growth in the U.S. and China along with new monetary stimulus in Europe, there’s a good chance that the global economy could surprise higher this year and support oil prices.

Even on a struggling near-term environment for oil, global demand for energy still paints a promising picture. In its 2035 Energy Outlook, BP forecast a supply deficit in every period from 2015 to 2035. Total consumption of liquids is forecast to increase by a 0.8% annual pace to 4.97 million tons of oil equivalent in 2035 compared to production increases of just 0.6% annually to 4.82 million tons.

Lower prices for oil are already hitting the industry and the number of drilling rigs in the United States has dropped to the lowest in four years. The number of U.S. rigs is now 20% lower than it was last year. While domestic production is still increasing on previous capital spending projects, I can’t help but get the feeling the knee-jerk reaction by companies of pulling rigs and cutting billions from investment spending will not lead to higher prices and lower production estimates by the end of the year.

Fundamentals

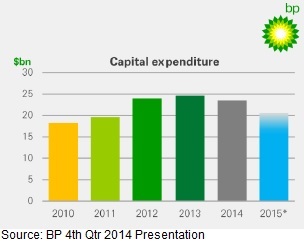

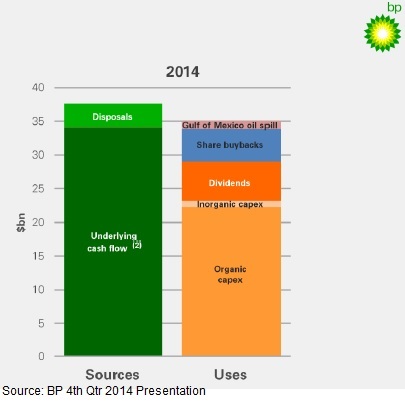

Sales have fallen over by nearly 5% over the last year but the company is still profitable to the tune of $9.5 billion. Operating costs did not decrease as quickly as sales so profitability took a hit but the company is addressing the issue this year. Even on the weakness in 2014, the company managed to book $9.9 billion in free cash flow after investing $22.9 billion in capital.

BP has over $31 billion of cash on its balance sheet and covers its near-term liabilities by 140% with current assets. The company uses debt to finance less than a third of the capital structure and would have no problem raising money to support cash needs.

The company will cut capital spending to $20 billion in 2015 to protect cash flow and is in the middle of a two-year plan to divest $10 billion in non-core assets. It is always during these times of industry weakness that companies look to efficiency and cost-cutting, something they should be doing all the time. The benefit to new investors is that this renewed focus on margins will pay off big time when oil prices eventually rebound.

Cash Return Supports Investment Until Long-term Demand Prevails

Shares of BP pay an extremely attractive 5.8% though the company is paying out 55% of income to the dividend. The company has boosted the dividend aggressively over the last three years with a 12.5% annual rate but it’s still lower over the last five years.

BP has paid a dividend since 1990 and has consistently returned cash to shareholders through a stock repurchase program as well. The company repurchased $4.8 billion in shares over the last four quarters, just over a billion less than was returned through the dividend.

Dividend growth will likely need to slow over the next year on lower income but the total cash return on the shares is still very high. The company is still free cash flow positive even after high investment spending so there should be no risk of a dividend cut.

Valuation

Shares trade for just 10.2 times trailing earnings though expectations for 2015 earnings are for just $2.01 per share. The company beat earnings expectations in the fourth quarter by 45% and my own forecast for earnings this year is at least $2.80 per share. That would put the valuation at 14.4 times expected earnings, not particularly cheap but not expensive either.

The share price has only been this low a few times over the past ten years; notably during the financial crisis and after the Maconda Gulf spill. While this year could still be rough for energy companies, the long-term story remains intact and BP provides a great cash return while you wait for shares to rebound. Taking advantage of the panic-selling that has happened over the last few months offers the opportunity for good long-term capital appreciation on top of the healthy dividend yield.

Agree with your long term outlook for BP as well as the other major players. This year could be pretty ugly but that’s when the really great companies swoop in to pick up cheap, quality acreage in prime production locations by purchasing other companies. I’m a bit leery investing more capital in the E&P area but that’s only because I work on that side. For investment purposes I’ll be staying away from the small E&P companies because there’s just no telling which ones will be able to survive the dip in oil prices. So I’ll focus on the major players that have been there and done that before with the boom and bust cycle of drilling. Another one I need to look at a bit closer is NOV.

What’s going to be really interesting is 6 months out from now. Most of the E&P companies have made significant cuts to CAPEX for E&P which will take a while to work through the system. One thing I’d really like to see is the number of wells that have been completed in the shale areas but have yet to be fracked. I haven’t found this statistic anywhere but it’d be interesting to see if it exists because I think that will be a indicator of a possible change in the direction of the price of oil. Most of the shale wells have a large initial production but the dropoff to the consistent production level is pretty stark. I can’t remember the timeframe off the top of my head for the drop but I want to say it’s <6 months. If there's a huge backlog of "frac" jobs that are being put on hold then I could see producers ramping up the "frac" production once prices increase to more profitable levels. That could lead to a double dip in the price of oil before a trend of growing prices again. If there's not a lot of wells waiting to be "fracked" then I'd expect a trend of increasing prices. I just realized that all of this sounds very much like a trader's perspective which I am nowhere near, but working in the industry those are my thoughts on how things will play out.

It's certainly a rough time and while a lot of people are touting how great the low price of oil is for the economy I can't help but think that they're missing the bigger picture that there's going to be a lot of people that lose their jobs/income and don't have the disposable income as well. Between the 3 big service companies, SLB, HAL, BHI, they've announced layoffs of over 20k people and there's still the E&P companies that will make some layoffs as well as the rig companies that will make significant cuts as well.

Thanks for the look at BP.

Thanks for sharing your insight JC. Its great to hear your perspective on this. I think it will be interesting to see how many jobs are lost and how that will compare to the increase in profits others will show. Time will tell.