Apple Company Investment Highlights

- The company has expanded its cash return policy but doesn’t quite pass my smell test for a ‘dividend’ stock

- Reliance on iPhone sales means each year must impress on a new launch or upgrade, something that could be difficult this year and next

- Shares are not particularly expensive at 15.7 times trailing earnings but still leave plenty of downside and little reason to jump into the stock

Apple Inc. (Nasdaq: AAPL) is a $728 billion global leader in consumer electronics and software. The company’s history shifted dramatically in 2001 with the release of the iPod and sales have grown quickly with successive products.

I get a lot of emails about Apple, whether dividend investors should include it in their portfolio or whether it is still really a growth stock. Apple bowed to pressure from activist investors like Carl Icahn a few years ago to start returning cash to shareholders. While the yield on the shares wouldn’t normally be something that would make it on my radar, its hard to deny the potential for Apple to return massive amounts of cash to shareholders.

Despite the lower dividend yield, I thought I would take a look at Apple and the outlook on the shares for the next year.

The Worldwide Developer Conference (WWDC), where Apple has historically talked about a lot of its new initiatives, wasn’t really that impressive this year. The potential for strong network effects in coming years is definitely there but I didn’t see much that stood out as potential for this year or next. The company is developing a really strong network of services around its consumer tech like Apple Pay, HomeKit, Apple Music and iCloud storage. This is where Apple is going to solidify its dominance in the future, by making so much of your software and tech gadgets Apple that you won’t be able to switch.

Even on Apple’s brand and strengthening network effects, profitability isn’t without risk. You only need to ask Blackberry (Nasdaq: BBRY) investors how quickly market dominance can evaporate if a company doesn’t continuously innovate. Apple has carved out a strong niche for itself at the top end of smartphones and products but is reliant on wireless carriers offering customer subsidies to afford the high-end phones. The four U.S. carriers subsidized the iPhone 6 buyers by an average $450 for a two-year contract last year. They make up some of that in charges over the two years but lower subsidies are a constant threat to Apple sales.

Apple’s recall of its iOS 8.0.1 and the poorly planned mapping software show that the company isn’t immune to the occasional slips that hit all tech companies. None of the company’s slips have caused much in the way of product delays or lost sales though and users are willing to shrug off some misses on the company’s great track record.

Company Fundamentals

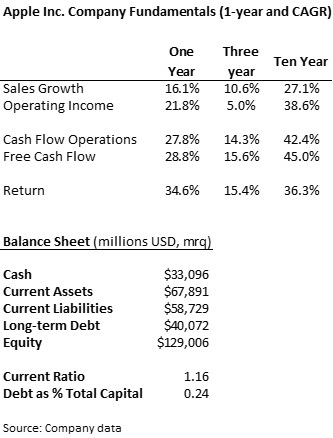

Take one look at the numbers and its clear that Apple isn’t the company it was even ten years ago. Cash flow from operations has surged over the last decade as Apple transformed itself from a computer hardware company to a consumer electronics powerhouse. Sales have surged over the decade and management has done a good job at controlling expenses, helping operating income to grow at a faster pace.

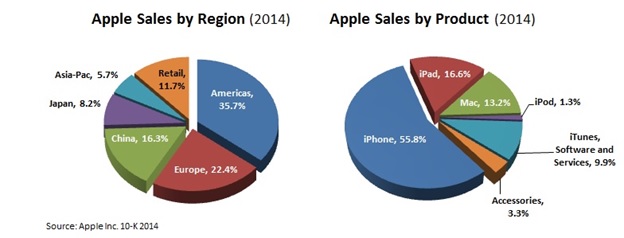

While sales are relatively diversified globally, the company is becoming ever more dependent on the iPhone. Sales of the iPod and iPad fell $3.8 billion last year though a $10.7 billion increase in iPhone sales picked up more than enough slack. This puts an increasing amount of pressure on the company, and the shares, ahead of each year’s launch or update of new iPhones.

Outside of China and Japan, Asia-Pacific sales were down 7% last year though the rest of the company’s worldwide sales were surprisingly resilient in the face of slow economic growth and a surging U.S. dollar.

Apple’s balance sheet is a favorite for discussion around analyst conversations. The company’s recent acceptance of debt in favor of cash return to shareholders has helped to moderate pressure from activists like Carl Icahn but many still feel that Apple isn’t doing enough with its balance sheet. The company has increased its use of debt but could still easily draw another $20 billion in debt to return to shareholders and only have about a third the capital structure leveraged.

I think this is the direction the company is going, gradually taking on more debt and balancing its dividend payment with a strong buyback program. Cash flow is incredibly strong and investors should continue to see a good cash return every year.

Apple Dividend and Growth

Shares of Apple pay a 1.6% yield, which normally wouldn’t even make my dividend radar, and pays out 24% of its income as dividends. Apple only just started really paying dividends in 2012, though it’s already returning $11.2 billion a year to investors.

Apple has grown its dividend at an 11% annualized rate over the last three years and should easily be able to maintain growth on its huge cash stockpile.

The company continues to aggressively buy back its own shares with $34 billion spent over the last four quarters. In fact, the share count has fallen just over 10% since 2012 for a nice little 3.5% boost to shareholder cash return each year.

Apple Stock Valuation

Shares of Apple trade for 15.7 times trailing earnings, just above the 15.5 average multiple over the last five years. On a book value basis, the shares look a little more expensive, trading at 5.6 times book value against an average 4.8 multiple over the last five years. While I wouldn’t say the shares are expensive, value investors should remember that the shares traded around 12 times earnings in 2012 and that earnings could come under pressure if the company doesn’t continue to impress on its iPhone line.

Expectations are for Apple to report $9.04 per share earnings for 2015, an increase of 40% on 2014 earnings off of a 27% sales increase to $232 billion. Sales are expected to slump to growth of just 5.7% next year and produce earnings growth of just 7.5% to $9.72 per share.

Apple is only a dividend stock because of its runaway success and I don’t think management has really committed to cash return. The yield is going to fall short of most dividend investors’ radar and the majority of return will be from price appreciation. I have yet to hear much from the rumor mill that would make me believe 2016 will offer much upside in sales growth.

The company’s long-term prospects are as good as they ever were but I just don’t see any rush to buy into the shares at this valuation and on the potential for a slowdown in the product cycle. As a dividend investor, I am not inclined to break some of my yield and payout rules lightly. I think Apple can be a good long-term investment but want to see a better value before I put my money down in a non-dividend focused stock. Slower sales growth could have investors reevaluating how much they’re willing to pay for the shares and I would wait for a better price over the next 12 months. Watch the shares and set a target of 14 times trailing earnings, which would mean $112.70 per share on the current four quarters’ of earnings.

Just as Microsoft became the de facto monopoly of desktop operating systems, I can see Apple doing the same thing mobile operating systems.

The ecosystem they’re building around iOS is astounding, and with each new device and each new iteration, the stickiness of the brand and product gets even stronger.

Apple is a dividend aristocrat in the making. 1.6% yield is paltry today, but I see them at a 4% yield with very easy dividend coverage in maybe 10 years.

In my opinion, it’s the single best stock to own.

Eric

iOS has less than 20% of the mobile marketshare so I’m not sure how you think it will become a defacto monopoly any time soon. Android has an 80% share of the mobile OS market.

I hold Apple and will continue to do so if growth continues to follow. A 11% growth is not too shabby. I too prefer a higher yield, but I’m ready to make compromise if growth is interesting and if I believe in the company. Maybe that’s where we’re different. I’m not saying there’s no risk (no investment is risks free anyway), but I still believe in Apple’s potential.

Cheers,

Mike

Good grounded analysis. I do not consider Apple a dividend stock, rather a growth stock that now pays a small dividend. Apple will likely be a solid long term holding for any investor if they can continue to dominate. I am watching it, and may jump in when it goes on sale.