Illinois Tool Works Investment Highlights

- Nearly a fifth of the shares outstanding have been repurchased over the last five years, boosting total cash yield

- Progress on restructuring and profitability is impressive but sales losses may be greater than estimated over the next year

- At a buy target of $85.40 the shares would be 17.5 times trailing, closer to the historical average and more attractive on a long-term basis

Illinois Tool Works (NYSE: ITW) is a $35 billion global manufacturer of industrial products and equipment. The company holds nearly 10,500 active patents with another 5,600 pending and 1,370 new patent applications across its seven business segments. Half of revenues come from North American clients (43% U.S.) followed by Europe, Middle East and Africa (30%), Asia-Pacific (17%) and South America (4%).

As a large, diversified industrial goods company, sales growth is closely tied to global economic growth. Over the four years through 2014, the company managed organic revenue growth (ex-divestitures) just 0.5% above that of global GDP growth.

The company is undergoing a multi-year restructuring plan, called the Enterprise Strategy, to simplify the business model and improve profitability. Through divestitures of 30 businesses, representing about $5 billion in sales, 800 total divisions have been reduced to 89 across the entire company.

As part of the company’s enterprise strategy, it is targeting an operating margin of 23% and 2% revenue growth above global GDP by 2017. The target seems reliant on management’s 80/20 business model of focusing resources on the 20% of clients that account for 80% of revenues. The 2014 Investor Day presentation calls for “aggressively reduced” overhead costs association with low value customers and products, i.e. the remaining 20%.

While this is a smart strategy and improves margins, but I wonder if management has fully evaluated how much business might be lost from the plan to cut overhead and service to the bottom fifth. The investor day presentation notes just a 1% drag on revenue growth in 2015 and less in 2016 from the strategy.

As we’ve seen from other international companies, ITW has seen earnings weakness over the last year on the strength in the U.S. dollar. Management expects this currency impact to reduce earnings by $0.15 per share in 2015. I think this could be one of the few points for upside in the shares over the next couple of quarters. The dollar has weakened from its March high against other currencies and European economic growth is returning slowly. The earnings impact from weak foreign currencies relative to the dollar may not be as large as some are expecting.

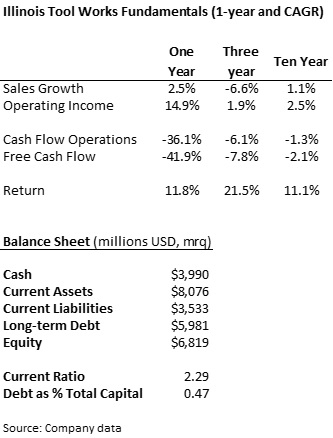

Illinois Tool Works Company Fundamentals

The number of divestitures since 2011 has weakened overall sales growth for the company but has made it a much more manageable business. The fact that operating income jumped nearly 15% last year on sales just 2.5% higher means management is making good progress on profitability. The operating margin of 20% last year is a big improvement from just 15% three years ago.

The company carries a lot of debt on its balance sheet, more than half (52%) of its capital structure. Interest rates are fairly low and there’s no risk of liquidity but I would look for management to focus on debt reduction from 2017 onward.

The steep drop in cash flows last year was mostly due to divestitures and other issues related to the restructuring plan. Capital spending has been fairly consistent around $360 million each year and there doesn’t appear to be anything pointing to a cash squeeze.

Illinois Tool Works Dividend and Growth

The dividend yield of 2% is just below the five-year average of 2.2% and reflects a lower payout ratio of 26% versus an average of 33% paid out over the longer-period. Management has targeted about $500 million for dividends in 2015 and dividend per share growth of just under ten percent.

The dividend has grown by a compound rate of 9.5% over the last five years and the company has paid a dividend since 1933.

The company more than doubled the share repurchase program last year, buying back $4.35 billion in stock. Most of this was related to returning cash from the divestitures but the company still has plenty of cash to continue a strong buyback program. The buyback program has been so aggressive that the company has reduced the share count by 19% over the last five years, buying back 95 million shares.

Illinois Tool Works Stock Valuation

The shares trade for 19.4 times trailing earnings, well over the five-year average of 16.3 times but right at the current industry average.

Analysts are expecting full-year 2015 earnings to be 5.1% higher to $5.13 per share on a 5.6% decrease in sales to $13.67 billion. Management has targeted $2 billion in 2015 cash return with approximately $1.5 billion in share repurchases. This would be less than the previous years but still a total yield of 5.6% on the current market capitalization.

I like Illinois Tool Works’ progress to its profitability goals and the share repurchase program helps make up for a relatively low dividend yield. I am not completely confident management can orchestrate the restructuring without losing more sales that it expects over the next year. The company may get a boost if the European economy surprises higher but I would hold off on buying the shares from here. A drop to $85.40 per share would still be 17.5 times trailing earnings but would make the stock attractive on a long-term basis.