While the market temporarily takes its eye off of rising rates to focus on geopolitical worries, I can’t help wonder if an increase in rates may take center stage as we head towards mid-year. Fear over higher rates and a restrictive monetary policy have led to market pullbacks over the past few years and the general view is that dividend stocks could take it harder than others.

So what really happens to dividend stocks when rates rise and should you be worried?

Federal Reserve Chair Yellen has done a pretty good job of talking expectations for a rate hike into market expectations. Market pundits and even Fed officials differ on when we might actually see higher rates but the consensus is for an increase this year to 1% from the historically-low 0.25% rate on Federal Funds.

Where rates go beyond that will depend on global economic growth, inflation and the job market in the United States. There is a decent chance that global growth and inflation pick up later this year with the largest central banks in the world, notably the European Central Bank and the Bank of Japan, firmly behind monetary stimulus and pumping out money. That would most likely mean rates here in the U.S. start a steady increase that could last a couple of years.

But what does that mean for dividend stocks?

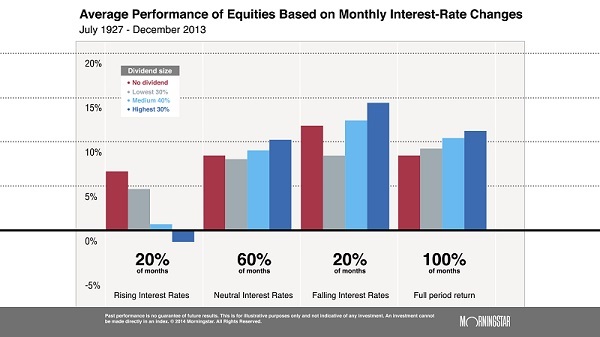

Research by Morningstar looked at the performance of dividend stocks over nearly nine decades to 2013. Stocks were separated into four categories ranked by their dividend yield. The highest 30% of dividend payers (dark blue) booked the best overall performance of the group, easily beating out stocks that paid no dividend (red bars). Good news for dividend investors.

The performance wasn’t steady across the whole period though. Over two-fifths of the time, interest rates were either rising steadily or falling throughout the period. High-yielding dividend stocks performed even better when rates were falling but underperformed all other groups when rates increased.

Why would this happen and is it something you need to be worried about, especially given the possibility that the Federal Reserve will start to increase rates this year?

Why high-yield stocks underperform during rising rates

There are a couple of reasons why dividend stocks may underperform others when rates increase. The most obvious reason is that dividend yields start to look less attractive against the yield on safer bond investments when rates increase. Dividend stocks have gotten a big boost over the last few years as bond investors searched for cash return on record low market rates. It makes sense that this increased demand for dividend stocks may come out of the market when rates head higher.

Another reason why high-yield dividend stocks underperform the market during rising rates may confuse the situation a little. Real estate income trusts (REITs) and business development corporations (BDCs) offer some of the highest rates around and would be a part of the “highest 30%” group above. These stocks may have a harder time when rates increase. They use large amounts of debt and refinance often which means that higher rates will lead to higher debt costs. The group also pays out nearly all of its income as dividends and must raise cash frequently. If debt becomes more expensive, the companies in the group may decide to issue more stock instead, leading to a dilution of current shareholders and lower prices.

While traditional stock companies that pay high dividends may see their price struggle from investor competition with bonds, it isn’t likely to be as bad as the chart implies.

Should I worry about my dividend portfolio?

High-yield dividend stocks still outperformed over the entire period in the chart above. Rising rates usually mean good economic growth and low unemployment so most companies should do pretty well. Utilities may underperform companies more closely tied to the growth in the economic cycle but could still do well.

At most, you might want to look at how much you have in high-yield stocks like REITs and BDCs. The Vanguard REIT ETF (NYSE: VNQ) has outperformed the S&P 500 over the last year by 10% and has booked a total return of 26% over the period. Valuations in REITs is now at 18.4 times funds from operations (P/FFO), well above the long-term average of 15.9 times FFO.

Other financial stocks, besides BDCs, may do better with rising rates as they collect a bigger spread on their loans. The Financial Select Sector SPDR ETF (NYSE: XLF) trades at just 14.8 times earnings and pays a 1.6% yield.

Larger companies in energy will be able to ride out the weakness in lower oil prices and could be good investments on an eventual price rebound. The Energy Select Sector SPDR ETF (NYSE: XLE) trades at just 14.1 times earnings and pays a 2.5% yield.

One of the biggest benefits to long-term investing, besides compounding interest, is that you don’t have to worry too much about near-term economic problems. I wouldn’t ignore super-high valuations or economic headwinds from rising rates but you likely don’t need to do much to get your portfolio ready. As always, look to valuation and think about trimming your position in some at-risk sectors while adding to sectors or companies that offer good dividends and long-term upside.

High dividend yield is not what I’m really searching for. I prefer looking at the growth rate and have a high quality history. Given all these criteria, I don’t think an increase in interest rates directly influence a well-built portfolio. Good article anyway!