The European Central Bank (ECB) announced one of its strongest stimulus programs yet to jumpstart the flagging economy and it looks like investors may finally be onboard, sending regional stocks up nearly 3% since the beginning of the year.

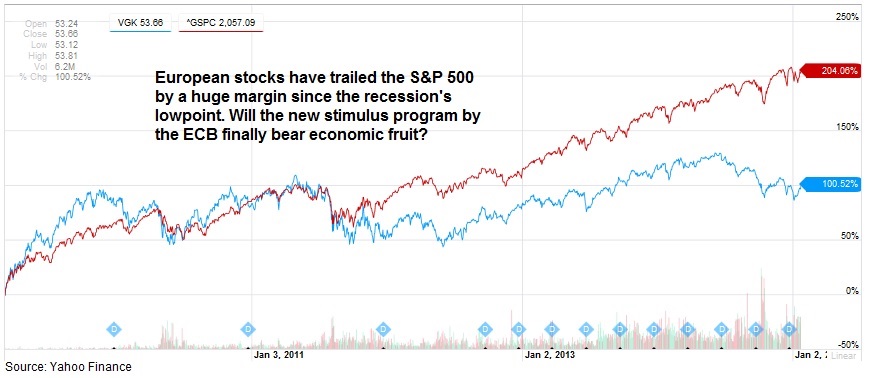

We’ve been here before with the ECB promising to help boost its economy, following moves by the U.S. and Japan, and each time has only brought disappointment and stagnant economic growth. The Vanguard FTSE Europe ETF (NYSE: VGK) has underperformed the S&P 500 by 104% since March of 2009 but I can’t help but feel like it might be time to look to shares of European companies.

Could 2015 finally be the year that European stocks rebound? Should you be looking ‘across the pond’ for some great dividend opportunities?

Priming the Pump

The ECB announced in January that it would start buying nearly $70 billion a month in bonds of member countries starting in March and ending late 2016. The move would boost money in the system by more than $1.3 trillion and is the biggest move from the bank yet. The ECB has tried other programs before but all failed to impress the markets and kickstart growth or stock prices. The problem has always been the German members and a few others deathly afraid of inflation that have voted to weaken stimulus measures.

Whether it helps to drive economic growth or not is a matter hotly debated by economists but it is pretty hard to deny that monetary stimulus has helped drive stock market gains across the globe. The idea is that a central bank can push short-term interest rates lower by buying short-term government bonds, increasing the supply of money in the economy. Lower rates are supposed to drive more risk-taking and investment as people look to other ways to use their money when bonds pay less.

The U.S. Federal Reserve was the first of the developed economies to act after the recession, buying nearly $4 trillion from November 2008 to late 2014. While economic growth has been decent, the stock market has jumped 130% over the period.

Japan started its own program in 2011 called Abenomics, named for its Prime Minister Shinzo Abe, and has progressively increased the program. While the central bank has not met its goal to increase inflation, the Nikkei stock market index has surged 95% in less than two and a half years.

Euro Stocks Offer Value and Dividends

Even if the European economy continues to lag the United States and other developed nations, regional stocks are offering some attractive dividends and valuations. All else equal, European stocks normally offer higher yields anyway because of cultural norms but some of the dividend yields are high even by their standards.

For direct investment, there isn’t much of a choice for the American investor. Because of the liquidity and size of the European markets, you do not see many ADR options as you do for other regions.

Banco Santander (NYSE: SAN) is one of the largest regional banks and pays a 7.8% dividend yield. The shares trade for 13.4 times trailing earnings but are not without risk. The Spanish economy is one of the weaker within the union and unemployment is still nearly 24% even after adding more than a quarter million jobs last year. With some of the ECB programs targeting bank lending, the shares might be a good bet for 2015.

ABB Ltd. (NYSE: ABB) is a power and machinery manufacturer for industrial companies and pays a 3.9% dividend yield. Shares are a little more expensive at 18.7 times earnings but have come down recently on the Swiss National Bank’s decision not to keep the national currency weak against the euro. If the European economy eventually rebounds, it will be good news for ABB and for the Swiss franc.

For foreign stocks, I prefer exchange traded funds (ETF) in most circumstances because it allows me to get exposure to stocks that are not available on the U.S. exchanges through ADRs. Many of these stocks are less expensive because they do not have the benefit of U.S. demand or they might be smaller companies. While an ADR traded in the U.S. would mean more liquidity, it is not necessarily a disadvantage to the company so buying ETFs might actually be a good way of finding those hidden gems that other U.S. investors won’t see.

The Vanguard FTSE Europe ETF is one of the best options among regional funds. The fund is very liquid with nearly five million shares traded daily and pays one of the higher dividends at a 4.6% yield. The fund is extremely well diversified with 526 holdings across 16 countries in the European Union. Shares trade for just under 15 times trailing earnings and has about the lowest expense ratio of ETFs at just 0.12% annually.

Whether you think the new program by the ECB will succeed where previous programs have failed or not, valuations on regional shares are relatively attractive. Even the recent election win by the anti-austerity party in Greece has not sidelined markets and I don’t think we’ll see another massive selloff. Investors are receiving a good cash yield for their patience and lower valuations could eventually mean higher returns.

DL,

The ECB stimulus thesis is strong. The weak link though is that all that stimulus is killing the exchange rate. For this reason, I recommend HEDJ at my blog. You get exposure to the big names in Europe (mostly dividend paying) and get a USD/EUR hedge with the ETF. I made this call on the 21st of Jan and stick by it: http://velociraptor.cc/blog/2015/01/21/ecb-to-increase-qe-buy-wisdomtree-europe-hedged-equity-etf-hedj/

I’m still not convinced European dividends in general are stable enough. There surely are good opportunities coming though from some well-known companies or those with strong fundamentals.

Hello from Spain.

About Banco Santander, just say they don`t pay a 7.8% dividend (they announced it a week or two ago). And when they did it was in scrip dividend (in stocks) instead of money.

Now they give 2.5-3% (I don`t remember it exactly) but in money.

Best regards