Investment Highlights

- Cardinal Health has built a dominant position in an industry with strong tailwinds but shares have gotten expensive over the last couple of years

- A partnership with CVS Health and the potential in China provide upside to the general optimism from aging demographics and universal healthcare coverage

- Dividend yield is not particularly attractive but the company makes up for it with an aggressive buyback program

Cardinal Health (NYSE: CAH) is one of the largest distributors of pharmaceuticals and medical supplies to hospitals and retail pharmacies. The company is a vertically-integrated business including procurement from drug-makers, packaging, inventory and logistics services.

The company announced a major partnership with CVS Health Corporation (NYSE: CVS) and the creation of the largest generic drug sourcing entity in the United States. The 50/50 partnership should be able to benefit from scale to buy generic drugs at cheaper prices and could improve profitability for Cardinal Health. CVS is the largest pharmacy provider in the country with more than a billion prescriptions filled over the last year.

Cardinal Health has also recently developed its China business and could be a major distributor in the country. While government control of the market and pricing makes it difficult to predict the affect on the shares, it could turn out to be a strong long-term driver for sales.

Probably the strongest driver for the company is the ongoing theme of aging demographics in the United States and newly passed universal healthcare. More than 10,000 people reach the retirement age every day through 2020 and healthcare spending increases every year. Universal healthcare coverage will also drive healthcare visits in other demographic segments though it may bring the government into pricing.

Despite the upside from aging demographics and universal healthcare, the company does face some risks in pricing pressures. As pharmaceutical prices increase, the call to curb the trend in drug spending and for greater transparency could hit the company’s ability to protect margins. Even against these risks, I like the company for its size advantage and fairly dependable sales in the industry. For retirees, positioning in drug makers and other companies in healthcare can be a good way to hedge rising healthcare costs.

Fundamentals

Sales have fallen over the last few years on pricing pressure for drugs but should rebound to a long-term trend. A long-term sales growth of 3% to 5% should be achievable and there’s upside in international growth. The company took a hit last year with some large, one-time operating expenses. I removed these charges to get a better look at the long-term, sustainable trend in operations. Even after the adjustment, the company saw operating income fall by more than 5% though its still on a positive trend over the last three years.

The company’s balance sheet shows fairly good financial health with nearly $3 billion in cash and good coverage of liabilities. Long-term debt is manageable at about a third of the capital structure and most customers are large, established healthcare providers.

The company managed to boost cash flow last year by collecting nearly a billion of the $6.3 billion in receivables it was due from customers. While it had a positive affect on performance last year, it might not necessarily be sustainable and cash flows would have been flat were not for the collection effort.

Dividends and Growth

Cardinal Health has not been a particularly strong dividend payer with a current yield of 1.7% that is just below the average of 1.9% over the last five years. The company pays out 41% of income just below the 46% average over the longer-term.

Dividends have grown at an annualized pace of 14.4% over the last five years and management should be able to maintain a good yearly increase on sales growth and a higher payout ratio. The company has paid a dividend since 1983 and has increased the dividend for 17 consecutive years.

What Cardinal Health lacks in its dividend payout is made up with an aggressive share buyback program. The company returned an average of $524 million to shareholders over the last three fiscal years and has recently boosted its share repurchase program to buyback $983 million over the last year. Along with the dividend, the company has returned $1.4 billion over the last year for a yield of 5.2% on its market cap.

Valuation

Against a good long-term performance and solid potential on universal healthcare coverage, it is hard to make the case for a buy recommendation on the basis of valuation. Shares of Cardinal Health trade for 25.6 times earnings, above the five-year average of 23.3 times earnings but still slightly below the 33.3 times multiple for the industry. Healthcare equipment suppliers have jumped higher ever since the latter half of 2013 so it appears that much of the additional optimism on Obamacare may be baked into prices.

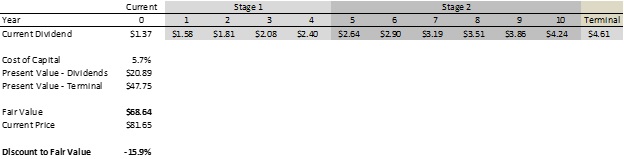

Discounting the stream of future cash flows confirms the overvaluation in the stock. For the DCF analysis below, I assumed dividends would grow at 15% annually over the next four years before slowing to a 10% rate in the second stage and then 8.5% into perpetuity. Sales growth should pick up over the next few years on a transition into universal healthcare but growth will probably slow after that.

A fair value of $68.64 on the DCF analysis would bring the shares back to 21.5 times trailing earnings and slightly below the longer-term average. Better still, waiting for a price of around $70 per share brings the yield closer to 2% on the shares.

Cardinal Health has a strong balance sheet and is well positioned for good sales growth as the nation transitions to universal healthcare coverage. The share price has more than reflected this and I would not be a buyer until the stock comes down a little. Put this one on your long-term radar and wait for a better price.

Thank you for pulling that analysis out. Been a long time I’ve seen one of this company. I put it on my radar a long time ago, but still wouldn’t be a buyer for now. Your stats prove my choice!