Investment Highlights

- Shares have come down from their high recently but might need to come down to below $80 to be an attractive buy

- The company’s strong brand and the steady improvement in the U.S. housing market should support moderate growth over the next few years

- A spin-off or sale of the security segment could unlock shareholder value but may take several years to happen

Stanley Black & Decker (SWK) is a global provider of hand tools and security solutions. The company books 78% of its sales from tools to the retail and industrial markets with the remainder coming from its electronic security systems and monitoring. While the hand tools benefit from a strong brand and customer loyalty, I am not sure the security segment really fits with the company.

The company books nearly half (47%) of its revenue from the United States, followed by 26% in Europe, 17% in emerging markets and 5% in Canada. With growth at a standstill in Europe, the company will have to rely on the rebound in the U.S. housing market for sales in the near-term.

The company moved into the security segment when it bought Niscayah Group, a Sweden-based commercial security and monitoring company, in 2011 for $1.2 billion. While the acquisition gave Black & Decker a more diverse product line and geographic reach, it is hard to see how it efficiently integrates with the hand tools segment. I think it’s possible that the security segment will be spun-off or sold in the future though it may not be for several years.

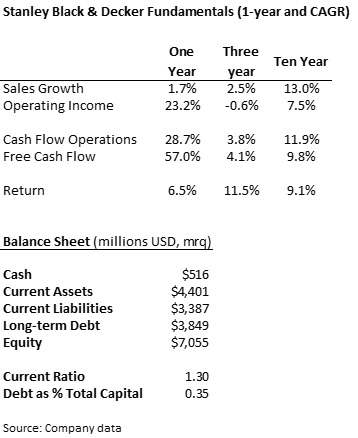

Fundamentals

Sales growth has slowed recently but has been relatively strong over the longer ten-year period. The industry is relatively mature and sales growth of between 3% and 5% is probably a good estimate going forward. Cost-cutting measures have really paid off over the last couple of quarters. The companies operating margin has improved from 6.6% in fiscal 2013 to just over 8.0% over the last four quarters.

Black & Decker is one of the more highly leveraged companies I’ve seen lately though that may not necessarily be a problem. The company holds $3.8 billion of long-term debt, a little more than a third of its capital structure. This is relatively high for a company in the retail consumer market. Still, interest rates are extremely low and the higher financial leverage allows the company to boost returns. Even in the event of a weak sales environment, the company should easily be able to cover interest expense.

Cash flow has improved in-line with the company’s strong improvement in operational performance. Cash flow from operations declined for two consecutive years through 2013 to $868 million but has hit a new high of $1.12 billion over the last four quarters. Black & Decker has been fairly consistent with its capital spending program, spending between $300 and $400 million per year.

Dividends and Growth

Management has been able to keep the dividend yield consistent despite a strong increase in the share price over the last several years. The current yield of 2.5% is just slightly over the 2.4% average over the five-year period. The payout ratio has decreased significantly to 54% from a five-year average of 82% due to an increase in earnings. This is a good sign for future dividend increases.

Black & Decker has increased its dividend by an annualized rate of 9.5% over the last five years and has raised the dividend for 46 consecutive years. While I think the company could sustain a high dividend growth rate, and maybe even increase payouts faster in the short-term, the ten-year average growth rate of 6.4% is probably a better estimate for the long-term.

Valuation

Shares trade for 15.8 times trailing earnings, well under the 17.8 times multiple where they traded at just a couple of months ago. Black & Decker benefits from a strong brand name and customer loyalty that goes back generations so probably deserves a slight premium on its valuation relative to the market. The dividend yield is well above the 1.8% average for the market as well, helping to attract some investor interest.

Even if the shares do not look expensive relative to the market, they still might be overvalued on a discounted cash flow basis. For the analysis below, I assumed an 11% dividend growth rate over the next five years before slowing to 8.5% in the subsequent period and then 7.0% over the long-term. This is still a fairly aggressive assumption that the company can increase its cash payout so quickly and consistently but may be possible in light of the low payout ratio. A fair value of $78.40 would still put the price at just above 15 times earnings over the last four quarters.

While the shares do not look overly expensive, especially on a price-earnings valuation, they are probably within 5% of fair value either way. I like the company’s strong brand and higher yield but am a little hesitant even after a pullback in the shares lately. The slow-but-steady rebound in the housing market should help growth over the long-term but I would wait for a pull back into $70s to really get excited about the company. There is potential in an eventual spin-off or sale of the security segment but investors may have to wait a while to realize a transaction.