It is rare that investors get a chance to pick up good dividend-paying stocks at a fear premium. You can either wait patiently for the entire market to selloff, like what we had in 2009, or you can wait for the sector or industry to selloff.

Since most high-dividend stocks are companies in extremely mature and stable industries, it isn’t often that the bottom completely drops out of the group. Sales are less likely to tumble for consumer staples and utilities even in a recession so stock prices rarely offer great value opportunities.

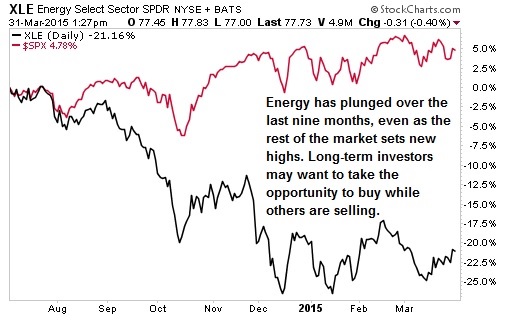

As the market has continued to make new highs, jumping for more than six years and looking pretty expensive, one high-dividend sector might just be offering one of those rare opportunities.

Like it or loathe it, the world will always need oil

You’ve probably guessed I’m talking about the energy sector, and more specifically the companies caught up in the 50% selloff in oil prices since last year. The Energy Select Sector SPDR (NYSE: XLE) has plunged 23% over the last nine months and trades for a price of 13.6 times earnings.

Perhaps the price of oil should not have been above $100 a barrel, especially after several years of booming production in the United States, but it also should not be as low as $48 a barrel either.

Even as the current price “war” between OPEC and U.S. producers keeps energy prices lower, global demand for energy paints a different picture over the longer-term. In its 2035 Energy Outlook, BP forecast a supply deficit in every period from 2015 to 2035. Total consumption of liquids is forecast to increase by a 0.8% annual pace to 4.97 million tons of oil equivalent in 2035 compared to production increases of just 0.6% annually to 4.82 million tons.

Lower oil prices are already having an effect, even if production has not topped off due to prior investment. The number of drilling rigs in the United States has dropped to the lowest in four years and is now nearly a third lower than last year’s high. Domestic production should level off this quarter and is set to start dropping in the second half of the year. This will start being accounted for in longer-term supply estimates and sentiment could improve on the sector very quickly.

Have oil companies seen the worst of the selloff?

According to FactSet Research, the oil & gas sector is expected to report a decline of 38% in earnings for the 1st quarter 2015 when reports start coming out this month. Every industry of the sector is expected to report an earnings hit except for the storage & transportation group.

I wouldn’t be so naïve as to call a bottom in the market but the sell off in the space, combined with good long-term fundamentals, could mean that investors have the opportunity to start picking up strong companies with great long-term potential.

Companies will likely lower their capital investment budgets further during their first quarter calls and will make the decisions necessary for long-term operations. Combined with this outlook for lower investment in production and the fact that production growth should start showing signs of peaking, the OPEC cartel could have its reason for a supply cut when it meets in June. The cartel has already said that production in the U.S. will likely start to fall later in the year and many of its members desperately need higher prices to balance their budgets.

The energy select sector fund offers a 2.35% dividend yield and is your most diversified bet on long-term returns. The largest integrated companies like Exxon Mobil (NYSE: XOM) and Chevron Corporation (NYSE: CVX) make up a significant percentage of holdings and add extra stability through their diversified operations and large cash stockpiles.

Chesapeake Energy (NYSE: CHK) has seen its shares fall by more than half from last year but has the fundamentals to make it through the near-term weakness. The company has expanded its portfolio to include more liquids production and diversify away from natural gas. The company has $4.1 billion of cash on the balance sheet and booked $4.6 billion in operational cash flow last year. Shares pay a 2.5% yield and sell for just 0.67 times book value.

National Oilwell Varco (NYSE: NOV) designs, manufactures and sells drilling and production equipment internationally but with a strong presence in the United States. Shares are down 42% from the 52-week high and trade for book value of assets. While it will take time for equipment demand to come back, the company has the size and balance sheet to survive. Even after $699 million in capital expenditures, the company booked free cash flow of $1.9 billion last year. The company holds $3.5 billion in cash on the balance sheet, enough to cover all the long-term debt and 17% of the total market capitalization.

The oil & gas sector will not likely surge higher on any rebound in oil prices but long-term investors don’t need it to in order to book great long-term returns. Picking up a few names in the space that have seen their shares plummet over the last year may be one of those rare opportunities to invest when the rest of the market is panic-selling.

NOV has been one of my favorite companies in the space but I’m also looking at adding to XOM over the next couple of months. I think the 3.25%+ yield is a great opportunity to get in on this O&G giant. The energy sector is definitely a “buy when there’s blood in the streets” sector at this moment and should provide long term investors with solid returns from these levels.

On a similar theme, I also like NRP. Coal has gotten killed and is absolutely hated. After the distribution cut, NRP got whacked again such that it now yields about 20%. The dividend looks safe [and how much further can coal really go? less than the cost of extraction??] and at some point growth in Asia has to drive fresh coal demand.

Oil has hit me hard, but didn’t sell. I still believe I won’t regret in a long-term perspective.

I do not think you will regret it at all. Just wait a year or two (I personally believe it will be just a year or less) and you will be back and collecting nice dividend in the meantime.

100% agree with you and do the same thing – buy energy stocks. They will pay back many-fold, if not this year, then next one or even the following one. But I am buying individual stocks, didn’t think about XLE. I might add a few shares of the whole sector though. Good tip.

This is a nice review of the opportunity we have in the energy sector. While I am not sure when, I know that oil will rebound soon. Plus those large integrated companies like XOM and CVX sell natural gas, refine products, so they are pretty stable.

I was hoping XOM will fall below $80, so I can build my position up. But I doubt we would see that price.