Investment Highlights

- PPG Industries has restructured to focus on coatings and paint, foregoing the benefit of diversification for possible competitive advantages in product focus

- Sales growth and operations have been well-managed but focus has come off the dividend and the quarterly payment has lagged. The yield is now just 1.2% but could increase considerably this year.

- Shares are too expensive at 23 times earnings and expectations may be a little high. I would be more comfortable if the price were to fall to $205 per share and the dividend were to increase to at least $3.00 per share.

PPG Industries (NYSE: PPG) is the world’s largest producer of coatings and paints for residential and commercial customers. Through acquisitions and divestitures over the past several years, the company has increased its revenue attributed to coatings from 50% in 2001 to 85% of total sales.

A lot of the company’s industrial business is in special coatings for aerospace customers but the increased reliance on the segment has made the company much less diversified than it was in the past. Nearly a quarter of sales come from international customers in developing nations so that should help to boost future growth.

The company spun off its commodity chemical business in early 2013 which has changed the outlook and business model. PPG used the cash to buy AczoNobel’s North American paint business for $1.05 billon, making it much more focused on the domestic paint market. While the increased focus could help it to lower costs and compete against competitors, it also makes it more susceptible to weakness in coatings and paints. The acquisition also made it more reliant on the North American market.

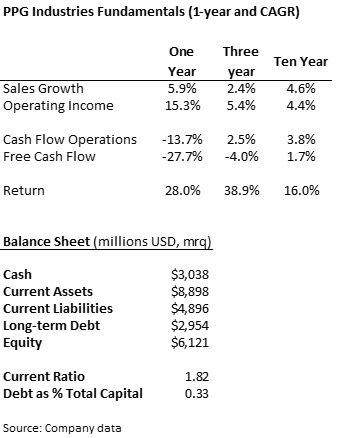

Fundamentals

Sales have grown at a strong rate over the past ten years, especially for being a mature industrials company. Revenue is closely tied to the economic cycle and sales dropped 23% in 2009. While the U.S. economy seems to be doing well and should continue modest growth, sales at PPG could fail to meet expectations if the economy were to slow.

Management has done a good job of bringing expenses down over the last year and operating income has jumped. The company holds just under a third of its financial structure as debt, higher than other industrial firms that see more sales cyclicality but not a problem for such a large, established company. Sales could weaken during a recession but the company has enough balance sheet health to weather any economic storm.

The drop in cash flow from operations is attributed to much higher net income last year on sale of discontinued operations. The company booked more than $2.1 billion last year from operations that were discontinued which did not come through as income this year.

Despite the weakness in operational cash flow, the company increased its investment spending which drove free cash flow even lower. The increase in capital expenditures should help to increase revenue going forward and improve cash flow.

Dividends and Growth

The dividend yield on shares of PPG Industries is one of the lowest among the Dividend Aristocrats at 1.2%, especially considering a 3% average over the last five years. The payout ratio has shrunk to 19% over the last four quarters against an average of 41% over the last five years. The reorganization to a focused coatings business is pretty much complete so I think management will shift focus back to dividends soon.

Much of the reason for the lagging dividend is because the payment has only grown at a compound rate of 4% over the last five years. The stock price has jumped higher and dividends have failed to keep up.

Despite the lagging dividend yield, the company does have a good history of cash return. Dividends have been paid since 1899 and have increased for 43 consecutive years. The company aggressively bought back its own shares over the last year with $1.1 billion returned to investors through the repurchase program. At the current valuation, I do not expect management to buy back many shares but I do expect an increase in the dividend.

Valuation

Shares of PPG Industries trade relatively expensive at 22.9 time earnings compared to an industry average of 17.4 times and the company’s own five-year average multiple of 20.4 times earnings. The company is more stable and offers a great history of cash returns, justifying a premium value against the industry, but a 32% premium on the industry might be getting a little stretched.

The market expects earnings to jump 17% this year to $11.49 per share despite expectations for a more modest 5.4% increase in sales. Earnings growth is expected to slow to 12% next year on sales growth of 4.8%, which is closer long-term average. I have a hard time seeing how the company is going to squeeze out earnings growth that is three-times its sales growth, even on improvement in expenses.

With the shares already expensive against its peers and its own long-term price multiple, the case is hard to make for any buy recommendation. As a dividend investor, the case becomes even harder to make for shares of PPG Industries. I generally do not even look at a stock unless it yields over two percent but make an exception for Dividend Aristocrats with a long history of cash return. Even a 1.5% yield for PPG would necessitate either a 29% increase in the dividend or a 22% decrease in the share price.

This was a good income centric analysis. I think you hit the nail on the head regard cash flows. It might be worthwhile to watch FCF for a couple years to see if that improves after fully digesting the acquisition.

Personally, I went FIRE in late 2012 and need current income so will not touch a sub 3% yield when I can get over 5% in tax exempt muni funds with short durations. The opportunity cost is just too high.

I agree with you and would wait to see how it goes after acquisition.