Highlights

- An exit from most publishing services leaves McGraw Hill as a focused information provider to financial services

- Standard & Poor’s still benefits from a strong brand within the financial community though recent regulatory actions could hit sales over the near-term

- Shares are expensive on a price-earnings basis and a discounted cash flow basis and the dividend yield is not high enough to compensate for the risk

McGraw Hill Financial (NYSE: MHFI) and its subsidiaries make up one of the leading ratings and financial information companies. The company went through a significant restructuring in 2013, selling many of its assets including its educational publishing division and some smaller publishing assets.

The company is relatively well-diversified internationally with 40% of sales coming from outside the United States. Nearly two-thirds of the company’s revenue is subscription-based with the remainder coming from transaction services.

The Commodities & Commercial division, which provides industry-specific information to the energy, automotive and construction markets have seen fairly weak growth over the last year. While the segments are still within the informational-services model, they don’t quite fit with the company’s direct towards a focused provider of financial information. I wouldn’t be surprised if these were the next assets to be sold.

The Securities & Exchange Commission (SEC) last week said that it would seek to suspend Standard & Poor’s from rating commercial-mortgage bonds on allegations it bent rating criteria to win business in 2011. S&P is a subsidiary of McGraw Hill and provides credit ratings for the bond industry. The action was not totally surprising after a previous notice in July that the SEC was investigating further action and McGraw Hill shares only declined a little more than 2% on the day. The ratings agency is also facing a $5 billion lawsuit filed by the Justice Department over residential mortgage bonds it rated leading up to the financial crisis.

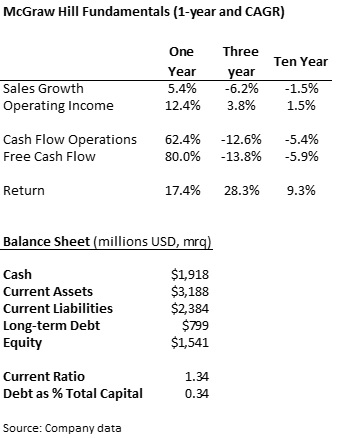

Fundamentals

Sales have increased over the last year but only off of a dismal 2013. Over the longer-term, revenue has been on a slow decline lower. The company has typically been able to find ways to cut costs so operating income has been positive. I’m not sure that the recent increase in sales is sustainable over the next few years and the company will probably need to focus even further on a few strong segments while selling off others.

Despite the weak environment for publishing and informational services, the company has a relatively strong balance sheet. Cash has increased to just over $1.9 billion in the last quarter and the company will have no trouble covering near-term liabilities. Debt makes up approximately 34% of the company’s capital structure though there are no maturities until 2017 so likely no problem with liquidity.

Cash flow has followed the same trend in sales, steadily declining over the last ten years though jumping over the last year. In light of the tough publishing environment, the company has pulled back on investment spending over the last several years. McGraw Hill has spent an average of $119 million on capital expenditures in each of the last three years, compared to an average of nearly $300 million over the prior three years.

Dividends and Growth

Management has not been able to growth the dividend to keep up with the share price over the last few years and the dividend yield has fallen to 1.3% from an average of 2.6% over the last five-years. The payout ratio has also fallen to 37% versus a five-year average of 49%, possibly in a move to conserve cash.

McGraw Hill has increased its dividend by an annualized 5.9% over the last five years and has paid dividends since 1985. Despite recent weakness in cash flow, the company has still managed to increase the dividend for nearly 30 consecutive years and is a member of the S&P Dividend Aristocrats.

The company has also regularly returned cash to shareholders through its share buyback program though less was repurchased over the last year to conserve cash. McGraw Hill repurchased $490 million in shares over the last four quarters compared to an average buyback of $995 over the last three fiscal years.

Valuation

Shares trade for a relatively expensive 27.9 times trailing earnings, just slightly above the industry’s average of 27.4 times but well above the company’s own 5-year average price of 18.9 times earnings. Earnings are expected to increase 12% in 2015 to $4.34 per share on 5.7% sales growth. Reaching nearly 6% sales growth is going to be difficult and it is equally unlikely that the company will be able to produce 12% earnings growth through an already pretty lean structure.

If it was hard to justify buying the shares on a price-earnings basis, discounting the potential cash flows to a present value makes it even more difficult. For the DCF analysis, assuming a 6% cost of capital, the company would need to increase the dividend yield by about 17% into perpetuity for the shares to be fairly valued at their current price. There is little chance of that happening and I would say the fair value of the stock is closer to $65 per share.

As a stock market analyst, I am familiar with the strong brand McGraw Hill has with its financial information services like Standard & Poor’s and S&P Capital IQ. The company has mostly exited from the weakening publishing industry but still faces low growth in its core services. Despite a fairly good return on the shares over the last few years, there is not much value left and the dividend yield isn’t high enough to keep me around.

Dividend Ladder,

Great analysis! MHFI is a quiet Aristocrat. It isn’t in the news frequently, which is a good thing! As you demonstrated, the company has strong fundamentals. For me, the valuation is a little expensive though, so I am going to pass until the PE retreats.

Again, thanks for the analysis. Another quick tidbit…they are expected t oannounce a dividend increase this month!

Bert, One of the Dividend Diplomats