Investment Highlights

- McCormick is the undisputed leader in its industry and one of the few with real brand strength through its private-label products.

- The company has been able to use its size and pricing power to drive sales growth that is surprisingly high for the industry.

- Non-voting rights for shareholders and share dilution in stock options is worrying but not enough to distract from strong performance.

McCormick & Company (NYSE: MKC) is the $9.6 billion leader in spices and seasonings with one-fifth of the global market. The company is four times the next largest competitor and controls nearly half of the market in North America. McCormick is one of the few companies in the industry to offer its own private-label product which helps it to protect higher margins through branding. There are two classes of shares with employees and founding family controlling the majority of voting rights.

The company recently announced its acquisition of Brand Aromatics, a supplier of organic flavors and concentrates, for $63 million. The purchase has been paid in cash and is nearly 10 times EBITDA. While the acquisition’s $28 million in annual sales is just 0.7% of McCormick’s $4.24 billion, the purchase helps increase its position in the organic category which is growing upwards of three times faster than the overall grocery category.

McCormick beat first quarter 2015 expectations for both sales and earnings even against unfavorable currency adjustments. Management lowered its 2015 guidance slightly to between $3.44 and $3.51 per share but expects sales to grow by upwards of 6% before currency impact. The continuous improvement program is expected to contribute $65 million in savings with additional savings from cost-cutting to total $20 million.

Management is targeting 20% of sales from emerging markets this year, up from 17% last year, and nearly half (40%) of total sales are from international sources. Expansion internationally offers revenue upside but also execution risks that the company may fail to match products with unique tastes in foreign markets. McCormick typically partners with local producers internationally to limit this risk.

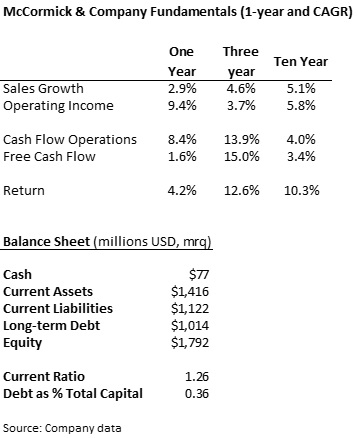

Fundamentals

For a 126-year old company in a mature industry, McCormick’s 5% annualized sales growth over the last ten years is extremely strong. The company has been able to use its scale advantage and private-label pricing to increase revenue faster than peers.

Recent efforts to cut costs have led to a strong improvement in operating income. Long-term debt is just over a third of the capital structure but should not present a liquidity problem, especially given strong operational cash flow.

Growth in free cash flow slowed last year on a big increase in investment spending, up 33% to $133 million. Free cash flow should improve in 2015 as the company consolidates acquisitions and focuses on efficiency.

Dividends and Growth

Shares pay a 2.1% dividend yield, just at the average over the last five years. The company paid out 44% of net income as dividends last year, slightly higher than the 41% average over the longer period.

McCormick has paid a dividend since 1925 and has increased the payout for 19 consecutive years. The dividend has grown at a 9% annual rate over the last five years.

While the company has increased its buyback program over the last several years, buying back $244 million last year, the diluted share count has only come down 3% over the last four years. This may point to an overly generous stock option plan for management.

Valuation

Shares of McCormick trade for 21.8 times trailing earnings, just above the 21.2 average multiple over the last five years. While the shares are not necessarily cheap, constant cash flows and dominance in its industry should carry a valuation premium against peers in the grocery industry.

If it were not for the company’s ownership and closely-held voting rights, I would say it would be a takeover target from a larger player. Kraft Foods (Nasdaq: KRFT), arguably a brand on par with McCormicks, is trading with an enterprise value around 21 times EBITDA in its talks to be acquired by Brazilian private equity firm 3G Capital. A similar valuation would put McCormick’s 40% higher than its current price.

Even without the possibility of an acquisition, McCormick is relatively cheap and a stronger outlook for free cash flow should drive investor cash yield. Analysts are expecting earnings at the top end of guidance this year which should support the share price. The lack of decrease in shares outstanding concerns me but I cannot argue with the company’s ability to use its position to generate sales.

MKC is a dividend legend. Perhaps its weaknesses work to our favor as they keep the valuation low, allowing favorable entry prices.

Thanks for sharing your thoughts Ladder. I do love a good monopoly, but this one is still too pricey for me. Have a great week

-Bryan

MKC is definitely a solid choice in the grocery department because we all need to eat and we don’t want bland food. Would love to buy some shares at a better valuation, specifically a higher dividend yield. But it’s hard to argue against MKC as a solid long-term holding.