Investment Highlights

- Hormel Foods has increased its dividend by a 15% annual rate over the last five years and has increased the payment for 47 consecutive years

- Dividend growth has not been able to keep up with the share price and the yield of 1.8% is just below the yield on the broader market

- Shares are at least 11% overvalued and mature market growth may not support dividend growth as it has in the past

Hormel Foods Corporation (NYSE: HRL) operates across five business segments, all in meat and food products. Refrigerated foods accounts for the largest share at 48% of 2013 sales, followed by Jennie-O Turkey stores (20%), grocery products (18%), specialty foods (9.1%) and international (5.3%). Sales are booked across ten countries including China though the United States still accounts for the majority of revenue.

The packaged food and meats industry is relatively mature in the United States and Europe though some growth still remains in emerging markets like China and Latin America. The maturity of the company’s core market means that acquisitions are the primary source of growth.

Hormel has not been as acquisitive as others in the industry but has increased its buying over the last year. The company acquired Skippy peanut butter last year for about $700 million, including business in China. Hormel agreed to buy CytoSport Holdings earlier this year for $450 million for its Muscle Milk product line. While the company does have some nutritional products, the purchase is a little outside Hormel’s competitive positioning in meats and processed foods. The bottled version of Muscle Milk is distributed by PepsiCo (NYSE: PEP) and leads its category while the product is also distributed through General Nutrition Centers.

The industry is prone to sudden changes in crop prices and not always able to pass those costs on to the consumer. Low agricultural prices over the last year have helped profits but may reverse in coming years if prices increase.

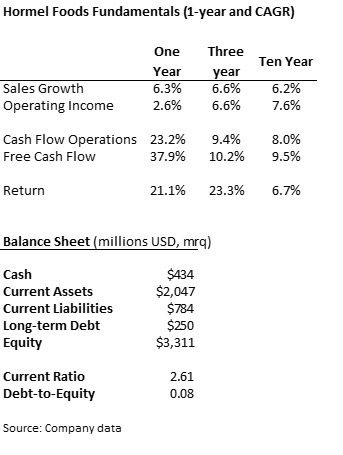

Fundamentals

Sales growth has been very stable over the last ten years while the company seems to have had trouble managing its costs over the last year. Beyond the weak increase this year, operating income has grown at a rate comparable with sales so we will have to wait to see if operating costs continue to increase.

A key opportunity for the company is through a greater use of financial leverage. Hormel uses almost no leverage in its capital structure with just $250 million in debt, roughly 6.5% of total capital. While this means financial risk is lower, management should be taking advantage of low rates on debt and an industry with reliable cash flows. Even a relatively low amount of debt around 35% of the capital structure, could raise upwards of $4 billion for growth acquisitions.

As with other companies in mature industries, cash flow has been consistent over the long-term and has increased significantly over the last year. The reliability of cash flow is another reason why I am surprised that management does not elect to take on more debt to fund growth.

Dividends and Growth

Despite the dividend growing at a rate of 15% annually over the last five years, the shares still only pay a 1.8% yield. This is right at the average yield over the last five years though the payout ratio has increased to 35% from a five-year average payout of one-third net income.

The fact that the yield has only kept pace with its longer-term average after such strong growth makes me wonder if the share price has not increased too quickly. Shares have surged at an annual pace of over 20% over the last three years, well beyond the ten-year average rate.

Management has maintained its commitment to shareholder cash return through the buyback program, purchasing $71 million in shares last year. Combined, the company returned $249 million to investors through the dividend and buyback representing a cash yield of about 1.8% on the current price. The company has paid a dividend since 1928 and has increased it for 47 consecutive years.

Valuation

Shares of Hormel trade for 23.6 times trailing earnings, expensive relative to a peer average of 19.3 times and the company’s average of 17.9 times earnings over the last five years. Earnings are expected 16% higher in 2015 against a 13% increase this year. Even on these expectations for 2015 earnings, the shares are expensive with a P/E of 19.8 times relative to the industry average.

I will say that I am impressed with the company’s ability to grow dividends by 15% a year for an extended period of time. Given the rate of sales growth and the lack of financial leverage, I do not see how it can keep the pace over the long-term. Even if the company were able to increase dividends by a 15% annual pace over the next ten years, the shares would still only have a fair value of $45 each on a discounted cash flow basis. That means the current price is at least 11% too high and possibly more if dividend growth fails to meet expectations.

Hormel does have some strong brands, such as Skippy and Spam, and can charge a slight premium on competitors’ prices. This helps to explain some of the valuation above the industry average but a price multiple 22% higher is not supported. I would be more positive on the shares if the price fell to around $42 per share which would only mean it was trading in-line with peers in the industry. The yield of 1.8% does not attract me as a dividend investor and the risk to lower prices has me waiting for a better entry despite the upside potential in acquisitions.