Investment Highlights

• Diversified position across property types and investments in one of the strongest investment themes

• Strong commitment to shareholder cash return with 29 years of dividend increases and an attractive 5.3% yield

• Relatively low valuation against peers and upside potential in the share price on top of the dividend

Most investors mistake HCP Incorporated (HCP) for strictly a play on senior housing but would be surprised at the level of diversification in the company’s assets. The company invests in five different property types. Senior housing accounts for a little over a third of operating income (36%), followed by skilled and post-acute facilities (31%), life sciences facilities (15%), medical offices (13%) and hospitals (5%).

Across these five property types, the company uses a unique investment strategy including: direct ownership, joint ventures, development, debt investment and RIDEA-TRS which gives it an extremely diversified portfolio of assets and operations. The company prefers triple-net leases with its tenants, meaning that the tenant pays all or most of the operating costs. While this reduces gross rent, it also significantly reduces costs and operational risk.

Shares have underperformed the REIT index and other healthcare peers since last October when the long-time CEO was fired. The board brought in Laurelee Martin, formerly the Chief Executive of the Americas at Jones Lang LaSalle (JLL), as the new head but has yet to define her own strategy.

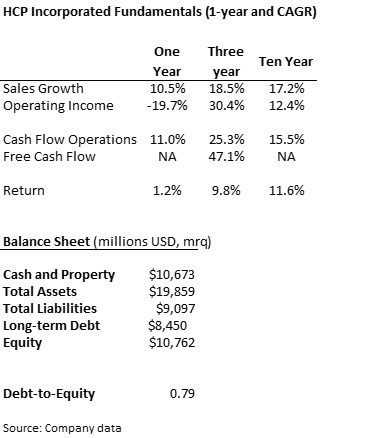

Fundamentals

Revenue has increased consistently though growth has slowed over the last year. The drop in operating income is misleading as significant cuts in 2012 operating expenses artificially increased operating results. Over the longer period, the company has managed its expenses well and operational results have increased relatively consistently.

Analyzing the balance sheet of a real estate investment trust is different from a traditional company. REITs do not generally carry a lot of cash or current assets on the balance sheet. Almost all the total assets are held in property investments and the companies are usually highly leveraged with debt.

While HCP has increased its use of debt over the past couple of years, now using it to finance 44% of the capital structure, the company’s financial leverage does not bother me. The company just recently completed a $350 million 10-year bond issue at 4.2% and increased its credit facility to $2 billion. This is positive over the near-term and the company should have more than enough liquidity without diluting shareholders with an equity issue.

Dividends and Growth

HCP is the only REIT in the S&P 500 Dividend Aristocrats index with 29 consecutive years of dividend increases. The shares pay a yield of 5.3%, slightly higher than the long-term 4.9% average, and dividends have increased by 4.2% annually over the past five years.

Despite relatively low growth in dividends, there is reason to believe that cash return can increase in the future. The payout ratio has decreased from 98% of funds available for distribution in 2010 to a payout of 87% in 2013. Funds available have increased by an annualized 7.2% over the last four years and sales could jump higher over the next few years as the Affordable Care Act brings tens of millions of new insureds into the market.

While the shares may not provide the highest yield or the fastest growth in your income portfolio, I believe they may provide one of the safest dividend streams. More than 10,000 people reach the age of 65 in the United States every day and seniors’ share of the total population is expected to jump to 20% by 2030. The growing need for healthcare and housing should drive sales higher over the next several decades.

Valuation

The shares are trading for about 13.7 times trailing funds from operations (FFO) which is just under the average 14.3 times FFO for healthcare REITs. This lower valuation is despite a yield that is higher than peers and a more diversified portfolio of properties and investments.

The shares look extremely attractive on a discounted cash flow basis with a nearly 17% discount to fair value. The value is based on three more years of relatively slow dividend growth at 4.5% until demographic trends and housing start to improve. After that, I can see the company returning to its long-term growth in funds available for distribution and a 6.5% growth rate in dividends.

While future performance will depend heavily on living preferences of seniors and construction to serve these needs, the outlook is strong for shares of HCP Incorporated. Besides a great position in the aging population theme, the company has a unique investment style that diversifies returns. Management has made a commitment to returning shareholder cash and will continue to reward patient investors.

HCP is one of the most diversified healthcare REITs in the industry. The firing of the CEO last year has left potential investors wondering whats next – including myself. Unfortunately, the board has not been very communicative regarding the firing of the old CEO. I like the potential that the company/stock has, but still standing on the sidelines. I ended up investing OHI instead last year, which has seen some great returns.

Thanks for the analysis

R2R

Great assessment of HCP. Out of all the REITs that exist I happen to like the health care REITs the best. As you mentioned, they fulfill a growing demand in our aging population that will require home, hospital and specialize rehab care. I have been watching the big three for a while, HCP, HCN an VTR with some of the smaller as well such as LTC, OHI and NHI. In general, this along with medial/pharma stocks, should do well in the coming decades.