Grainger Investment Highlights

- Grainger is the leader in a highly fragmented market and may be able to acquire smaller rivals to improve pricing power

- More than a third of sales are from online, giving it a strong position for future growth as more retail goes virtual

- The company has committed to repurchasing 18% of outstanding shares over the next three years, building strong support for the share price

W.W. Grainger (NYSE: GWW) is the leader in North American maintenance and repair supplies for the industrial customer. The $16.8 billion company sells the products of 3,400 suppliers from electrical generators to hand tools and cleaning products, reselling through its retail and online channels.

In business since 1927, Grainger is one of the lesser known plays on the re-emergence of American manufacturing. Rising wages abroad and stronger domestic economic growth have led to a re-shoring of manufacturing in North America as companies seek to build products closer to customers. Much like the gold boom of the mid-19th century, Grainger may be the best way to play the manufacturing boom as a supplier to companies rather than investing in the companies themselves.

The maintenance, repair and operations (MRO) market is extremely fragmented with the top 50 companies only controlling about 32% of the $150 billion North American market. Grainger is the leader with 6% and derives nearly all its sales from the United States (77%) and Canada (12%).

The market fragmentation means tough competition and lower margins, though larger players like Grainger are able to use some scale advantages to lower costs. Large customers make up 77% of industry sales which means further weakness in negotiating power for sellers.

On a strong outlook for industrial and manufacturing demand over the next several years, Grainger may be well-placed to make acquisitions of smaller rivals. Management seems to be favoring shareholder cash return but may decide to spend more towards industry consolidation.

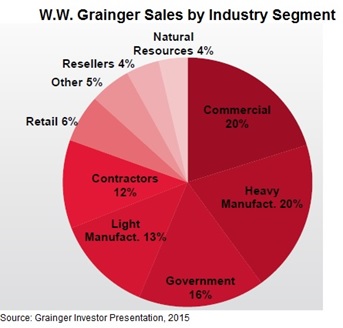

Against high industry competition and strong buyer negotiating power, Grainger does have some brand strength as the industry leader. The company is well-diversified across industry buyers, helping to smooth sales on weakness in any particular segment.

Grainger has been aggressive at building its virtual presence and books 36% of sales online, compared to 21% in 2008. While customer loyalty may be weaker for online sales, selling through online channels is much cheaper and online buying is increasing at a faster rate than in-store purchases. Besides the potential for Grainger to take advantage of consolidation, its strength in online retail should help it outperform peers.

Grainger announced in April that the board of directors had approved a permanent change in the company’s capital structure, increasing the debt-to-EBITDA ratio up to 1.5 times. Over the next three years, the company will issue approximately $1.8 billion in long-term debt to increase share repurchases. Along with internally-generated cash, the company plans on buying back up to $3 billion in shares.

Insiders own 13% of shares with another 74% of shares outstanding in the hands of large institutional firms. At the current price, the proposed buyback plan amounts to 12 million shares or 18% of the 67 million shares outstanding. With a high level of insider ownership and strong institutional interest, this amounts to a great deal of support for the share price over the next three years.

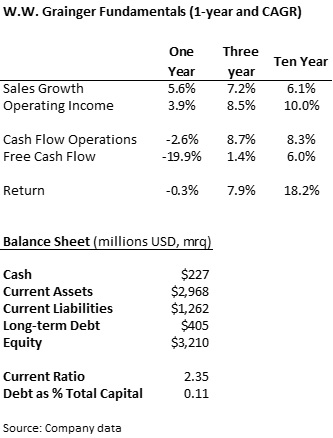

Grainger Company Fundamentals

Sales growth has been consistent over the last decade, increasing slightly over the past few years. The company has generally controlled costs and been able to grow operating income at a faster pace.

Grainger’s balance sheet is one of the only points of hesitance for me on the shares. Cash on the balance sheet has decreased over the last five consecutive quarters and is now just 1.4% of the market capitalization. While cash flow is high enough to support the dividend and buyback plans, there isn’t much room for capital projects or acquisitions without taking on more debt.

Capital expenditures surged 42% last year to $387 million leading to a steep drop in free cash flow. Spending this year is forecast to be just as high, in the range of between $375 million to $425 million. Increased expenditures have been for acquisitions and distribution, so positive for future cash flow but the company may have to reduce shareholder cash return slightly if it wants to keep spending at this rate.

Grainger Dividend and Growth

Grainger’s dividend yield of 1.7%, against a five-year average of 1.4%, isn’t usually the kind of thing that would show up on my radar. The company’s strong buyback policy helps to make it more attractive with a total cash yield of over 4% on the current market cap.

The company has increased its payout recently, paying 38% of income as dividends from a five-year average of 33% payout. The dividend has grown at an extremely aggressive 18.6% annually over the last five years and has increased for 43 consecutive years.

The company’s buyback program is nearly twice the size of the dividend payout, making up for a low dividend yield. Grainger returned $525 million to investors in the form of share repurchases last year and has progressively increased buybacks every year of the last three.

Management has said that the buyback this year will be lower, in the range of $375 to $425 million, with a dividend payment of $320 to $335 million.

Grainger Stock Valuation

Shares of Grainger trade at 21.5 times trailing earnings, just above the five-year average of 20.7 times but below the average of 27.5 times on its five closest competitors. The valuation is a little high, especially for a company in a mature industry and facing strong competition, but the three-year cash return policy should support appreciation.

Grainger missed expectations for $3.14 in earnings per share when it reported first quarter 2015 results mid-April. Adjusted earnings per share of $3.10 were flat against the year-ago quarter on sales of $2.44 billion, up 2.3% from last year but also missing estimates for $2.46 billion. Foreign exchange issues, mostly from its Canada business, led to a 3% reduction on sales and the weakness in results. Despite the weak earnings report, shares traded basically flat due to strong comments to the cash return policy.

Management has guided 2015 sales from 1% to 4% growth with foreign exchange subtracting 3% from organic growth of 4% to 7% on the year. The company is targeting earnings growth of up to 6% on expectations for no change in margins. This guidance is a little higher than analysts are expecting, with the consensus of 2.5% earnings growth to $12.57 per share on 2.2% sales growth to $10.18 billion.

While Grainger faces some headwinds on industry competition and the shares are not necessarily cheap, there is a lot to like about the stock. The company’s size gives it a price advantage and it would benefit from some industry consolidation. The new three-year cash return policy should support the share price and investors should see a total yield of between 4% and 7% on the buyback and dividend.

Great company. I think it will work out well for you. My focus for now is options premium and adding to my stache of municipal bonds. I’ll keep this deep on my list for future consideration though once I’ve finished upping my muni/bond AA.