Investment Highlights

- Dover uses an acquisition strategy to add businesses within its industrial focus and then lets the companies operate on an independent basis to allow flexibility

- Energy weakness has hit sales and sent shares lower but the company still generates nearly a billion in free cash flows

- The potential for more spinoffs, divestures and a cost management program should support the shares near-term while long-term upside is still intact

Dover Corporation (NYSE: DOV) is a global industrial conglomerate with 40 separate businesses across four segments; engineering systems (33%), energy (25%), fluids (16%) and refrigeration (25%). The company books nearly half of its sales from international sources.

Up until late last year, the company was doing well on U.S. economic growth and the revolution in domestic oil production. The drop in oil prices has severely hit the outlook and shares have dropped 4% over the last twelve months.

Dover runs a common business model for conglomerates, focusing on acquiring smaller companies within its segments and banking on the economies of scope. Dover allows the acquired companies to operate an a fairly independent basis which helps to bring flexibility where most large conglomerates lack the ability to change.

While the business strategy drives greater sales through bundling product offers to customers, management has also looked to efficiency lately and divested non-core businesses. Dover spun off most of its communications technologies segment with the issue of shares in Knowles Communications last year. Knowles took with it manufacturing of consumer electronics and medical technologies. Dover maintained its aerospace and defense industry technology manufacturing. The spinoff was meant to help Dover focus more closely on the industrials sector.

The weakness in energy and continued poor economic growth in Europe has me wondering if we will not see more spinoffs, divestitures or cost measures this year. An uncertain environment for spending on energy exploration will limit stock gains this year but measures to control costs or increase profitability could provide support.

Over the longer-term, Dover should benefit from an economic recovery in Europe. The European Central Bank has just recently committed to the kind of monetary stimulus that has driven growth in other markets and may see its economy pick up later this year.

Fundamentals

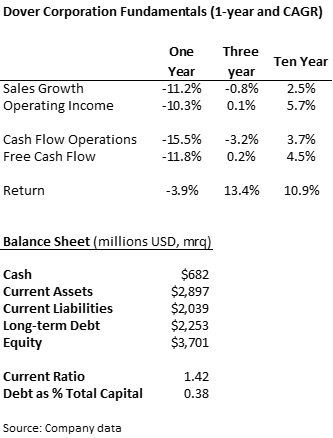

Sales plummeted in 2014 to $7.75 billion and are expected flat this year on weakness in the energy market. The company works with drillers and explorers in pumps, sensors and monitoring solutions. Capital spending by in the exploration industry is going to be weak for at least a year but long-term energy demand remains intact. As a diversified conglomerate, sales will approximate the rate of economic growth and should rebound to between 3% and 4% over the longer-term. With cost measures and use of debt, this is enough to provide for a growing cash yield to investors and modest increases in the stock price.

Operating income has grown at a slightly better rate than sales, showing that management is able to control expenses for profitability. Even on declining sales, the company is still financially healthy with nearly $700 million in cash and current assets that cover short-term liabilities.

Debt is building on the balance sheet at 40% of the capital structure, higher than most other industrials but rates on 10-year bonds are still below 4 percent. The company still generated free cash flow of $800 million last year, more than enough to cover investor cash return.

Dividends and Growth

Even against the recent weakness, the company has held surprisingly close to its cash return policy. The shares pay a 2.2% yield, just over the 2.1% average over the last five years. The payout ratio of 34% is also very close to the longer-term average.

Dover has increased its dividend by a compound rate of 8.6% over the last five years and has increased the payment for 59 consecutive years. Dividends have been paid on shares since 1947.

Dover has consistently returned money to investors through its buyback as well and even increased it to $601 million last year despite the weak sales environment.

Valuation

Shares of Dover trade for 15.8 times trailing earnings, well under the average of 19.8 times for the industry and right at the company’s five-year average multiple. Analysts expect sales flat this year and up 2.6% next year to $7.96 billion. Profitability took a hit last year to a net margin of 10% but was 11.5% just the year before. On the tough sales environment, I would expect management to look to cut expenses and increase profitability.

Even if management is able to squeeze costs and increase profitability by half a percent to 10.5%, earnings could increase to $4.99 per share this year. That would take the shares to $79.86 on a 16 times price multiple, nearly 9% higher plus investors still benefit from a decent dividend yield. I think this is a conservative estimate and shares could do even better on any news of asset sales or spinoffs.

I am not usually a big fan of conglomerates as investments. They have a tendency to grow too big to manage and profitability lags smaller companies. Dover seems to have found a good strategy with relatively independent operating divisions and its operating margin is relatively high compared to peers. The recent selloff due to energy weakness provides a good opportunity for investors looking for a stable dividend and the potential for long-term price appreciation.

Nice pick that was not currently on my radar. I’ll add to watch list but I am already overweight energy and won’t pull the trigger unless I trim something first.

Thanks for sharing Ladders. I wasn’t aware of Dover. I’ll have to dig a little deeper. Have a great week

-Bryan