Match Highlights:

- AstraZeneca may have the higher dividend yield but the payout ratio is unsustainable, especially on uncertain sales over the next couple of years.

- Merck is slightly less expensive on a relative basis and benefits from stronger expectations for future earnings growth.

- Both companies face patent expirations of blockbuster drugs but AstraZeneca’s cliff is steeper and may have less new drugs to cushion revenue weakness.

Stocks in the drug manufacturing segment are some of my favorite for long-term dividend return and price appreciation. The massive demographic shift in developed markets promises strong demand for pharmaceuticals even on the threat of government regulation.

Earnings at drug makers have been lumpy over the last few years, rising and falling abruptly as key drugs come off patent protection. Fortunately, drug companies spend billions annually in research & development to plug the holes left by older drugs. While growing demand on aging populations keeps cash flow relatively decent, all it takes is one or two blockbuster discoveries to send shares zooming higher.

But how do the stocks within the sector stack up against each other? How do you pick the best of breed among the many choices?

This post is the first of many that I will be doing over the coming months comparing companies within the same industry, not just among drug makers. I hope to get a good conversation going with each article so please include your thoughts on the match-up in the comments below.

A Battle of Two Goliaths

Let’s look at two of the largest players in the drug manufacturing industry, both with strong dividend yields. Both Merck and AstraZeneca have performed relatively closely over the last three years though AstraZeneca has recently moved higher. The outperformance may be short-lived though as the AstraZeneca faces a steeper patent cliff and uncertain sales over the next couple of years.

Merck & Company (NYSE: MRK) is one of the world’s largest pure-play drug manufacturers at a market cap of $163.6 billion. Shares pay an attractive 3.1% dividend yield and a total yield of nearly 8% if you include the share buyback program. The company has increased its dividend at a compound rate of 3.4% over the last five years.

The company recently reported strong results on its Keytruda melanoma treatment and has filed for U.S. Food and Drug Administration approval as a treatment for patients with no-small cell lung cancer. The consensus is that the drug could lead to sales of $4 billion by 2020 and the actual number could be much higher as the company positions for the $30 billion immune-oncology market.

As with the rest of the industry, Merck has its own patent cliff to deal with but losses may be spread over a longer period than peers. Zetia, with annual sales of $3 billion, loses patent protection in 2016 and Nasonex will lose protection the year after. The company has already passed through much of its patent cliff and sales on new products look promising for the next few years.

Shares trade for 16.5 times trailing earnings but 17.1 times expected 2015 earnings. Earnings are expected to rebound 12% in 2016 to $3.78 per share after falling 3.7% in 2015.

AstraZeneca PLC (NYSE: AZN) is the relatively smaller rival but still massive at a market cap of $92.6 billion. The U.K.-based drug maker pays an extremely attractive 5.5% dividend yield, one of the highest among the majors. The company has increased its dividend at a compound rate of 4% over the last five years.

AstraZeneca faces a huge problem with the patent expiration of Nexium and Crestor in 2015/2016 with only marginal new products to fill the gap. Forxiga may do well as a new diabetes therapy and Brilinta could be a multi-billion dollar cardiovascular drug, but the company may have a hard time replacing revenue if generics take some of the combined $9.1 billion in annual sales from Nexium/Crestor. Worse still, the drugs coming off patent protection hold relatively high profit margins and may be replaced by less profitable drugs.

Shares trade for 17.1 times trailing earnings but 17.5 times 2015 expected earnings. Earnings per share are expected lower by 1.9% this year and 3.6% to $4.05 per share in 2016. While the company is in the middle of a major cost-cutting program, it may be difficult meeting earnings expectations on lower sales over the next two years.

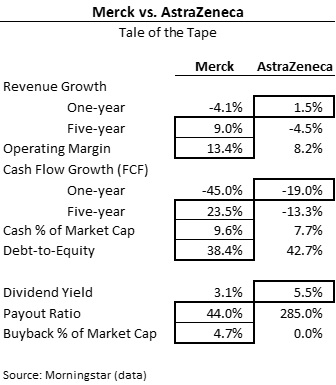

Tale of the Tape

Both companies have struggled with patent expirations over the last few years and free cash flow has fallen recently on higher R&D spending. Merck wins out on several metrics including important ones like operating profitability, debt-to-equity and payout ratio.

Over the next couple of years, as AstraZeneca struggles to support sales, it may not be able to support its dividend yield or growth may not be as strong as it has been in the past. I like Merck’s balanced approach at cash return with a strong share buyback program and a reasonable dividend. Putting money to a repurchase program instead of everything to dividends gives management some flexibility if cash flow weakens a little and avoids the stigma of a dividend cut.

If you don’t want to pick sides, the Market Vectors Pharmaceutical ETF (PPH) provides broad exposure to 25 of the largest U.S. listed pharmaceutical companies. Merck accounts for 4.9% of assets while AstraZeneca is 4.6% of assets. The yield is a little feeble at just 1.56% but the diversification is nice and the shares trade for 26 times trailing earnings, an average across the industry.

I’m concerned about the decline in growth, especially cashflow… I can see as you mention that they struggled with patent expiration but doesn’t smell so good in my point of view.

Cheers!

Mike