Investment Highlights

- A strong commitment to cash return with dividends accounting for most of investors’ ten-year gain

- A healthy balance sheet in a relatively stable industry means consistent long-term performance

- Shares are expensive and investors may want to set an alert at $46 to wait for a better price to start a position

Cincinnati Financial Corporation (Nasdaq: CINF) is likely to be one of the least well known of the S&P Dividend Aristocrats but is among the largest U.S. property casualty insurers. The company underwrites premiums in 39 states with commercial lines accounting for the majority of business, 67% of $3.9 billion 2013 premiums, followed by personal lines (25%), life policies (5%) and E&S (3%).

There is actually very little in the press about Cincinnati Financial, which may or may not be a good thing for investors. As an insurance company, premium growth is fairly stable and underwriting standards keep losses under control. Investors have enjoyed a compound annual return of 6.3% over the last decade, 4.9% of which was from dividends.

Lack of news may also give investors a false sense of security in the shares. There is really little investors can use to analyze the value of the shares beyond the company’s quarterly and annual reports.

The company is on track to reach its premium target of $5 billion in 2015 with growth across all underwriting segments. The excess & surplus line has been the standout with 25% growth in net premiums during the first half of 2014 and a target of 12% annualized growth through 2015.Ten states, mostly in the Midwest and Southeast account for 65% of premiums though the company is in an ongoing plan to expand its geographic reach.

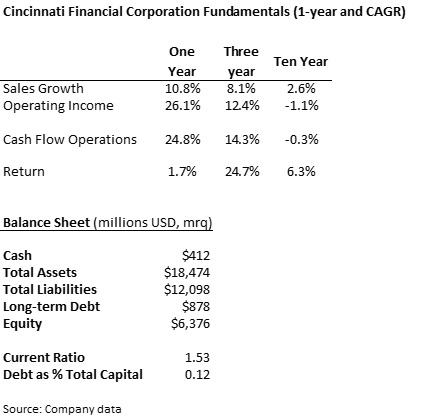

Fundamentals

Sales have grown at a more consistent rate just under 3% over the last decade while the geographic expansion program has helped to grow faster over the last few years. Management has also done a better job of managing operating costs lately.

The balance sheet of an insurance company is more similar to that of a bank than you see for other industries. Probably the most important account to watch is the company’s level of cash relative to assets. Cincinnati Financial carries enough cash to meet its needs but not so much to act as a cash drag on returns.

In-line with the improvement in sales and operating costs, the company has seen a strong improvement in its cash flow over the last few years as well. While longer-term results are not likely to be as strong, they should still settle around a respectable range in the high single-digits.

Dividends and Growth

Cincinnati Financial offers one of the higher yields of stocks in the S&P Dividend Aristocrats with a yield of 3.4%, though the yield is well under the 4.3% average over the last five years. Dividend growth has been relatively slow at an average of 2.2% over the last five years but the payout ratio has come down to 60% from the average of 79% over the period. This could help management to increase the dividend payment in the years to come. Dividend growth has averaged 5.3% a year over the last decade.

Cincinnati Financial Corporation announced a dividend increase in August marking its 54th year of consecutive increases for a dividend payment that goes back to 1954. Share buybacks have not been consistent lately but still allow for some increase in shareholder cash return. The company has bought back shares in eight of the last ten years, buying $52 million in 2013.

Valuation

Shares trade at 17.7 times trailing earnings, just over the five-year average of 17.1 times earnings but well over the industry average of 11.9 times. Some of the stock’s premium on industry peers is likely due to its higher dividend yield against the industry average. The stock’s price-to-book value, a better measure of value of financial companies, is 1.3 times and closer to the industry average of 1.2 times book value.

While the relative valuation may suggest only a slightly expensive stock, a discounted cash flows approach suggests the shares are overvalued by 10% or more. For the fair value analysis, I assumed the company can increase its dividend growth to 4.5% over the long-term and assigned a 5.8% cost of capital. The results offer a fair value of $45.91 per share, just over 10% below where the shares are currently trading. Fair value estimates do not account for strong investor sentiment due to a high dividend yield but the shares are definitely susceptible to a drop in price.

I like Cincinnati Financial Corporation for its strong commitment to shareholder cash return and its fairly stable industry. The geographic expansion program should continue to help boost growth in net premiums and the company has a strong balance sheet. The high price of the shares worries me a little as does management’s past of poor cost control. I think this is definitely one you put on your radar but set an alert for $46 per share and reevaluate if the alert is triggered.

Thanks for the write up Zach. Your headline sums up my feeling about most of the companies on my watchlist! Have a great week. I hope you’re doing well

-Bryan

I’ve looked at CINF a few times. I wonder about their occasional stock splits. Like 105:100 or 21:20. Kinda weird.