Investment Highlights

- Shares are fairly valued and maybe even slightly overvalued but high capital expenditures could soon pay off with a boost to cash flow

- Aggressive spending on Australia LNG projects and European shale gas make Chevron one of the strongest international plays among the U.S. majors

- The company’s size may also work to its disadvantage as large amounts of capital expenditures will continuously be needed to maintain production

With a market cap of $247 billion, Chevron Corporation (CVX) is one of the world’s largest integrated oil companies. The company produces 2.6 million barrels of oil equivalent per day with nearly 67% of that in crude oil and has refinery capacity just over 2.0 million barrels per day. Chevron reported proven reserves of 11.2 billion barrels of oil equivalent at the end of 2013.

The company has shifted its expansion strategy over the last couple of years to focus on liquefied natural gas and has two large projects in Australia that will contribute significantly to revenue in 2015 and 2016. Chevron increased its LNG exposure recently with purchase of a 50% interest in the Kitimat LNG project in Canada.

Chevron has been one of the most aggressive of the major integrated players in the search for non-conventional production in Europe. The shale boom has not developed as quickly in Europe as in the United States and hydraulic fracturing (fracking) faces moratoria in many countries. Still, constant threats to natural gas supply from Russia have driven the region to reevaluate its stance. Chevron has been awarded exploratory permits in Ukraine and is partnering with a Polish company in four licensed areas. Bulgaria has recently softened its position on fracking and has granted Chevron a permit to explore the country’s estimated 17 trillion cubic feet of gas reserves.

Even as Chevron expands its interest in other regions, it may be downgrading exploration in riskier areas. The company recently sold its assets in Southern Chad for $1.3 billion. Chevron owned a 25% stake in an oilfield and pipeline with approximately 18,000 barrels of daily production.

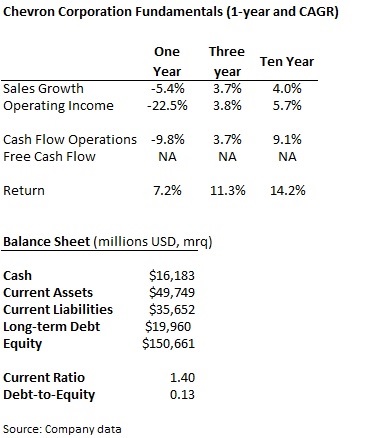

Fundamentals

The company stumbled last year with a 5.4% decline in sales though growth over the last three and ten years has been consistent. Lack of focus on costs drove a decline of 22% in operating income and negative free cash flow.

Despite operational weakness last year, the company still has a rock-solid balance sheet with more than $16 billion in cash an under $20 billion in long-term debt. Chevron uses debt to fund just over 13% of its capital structure, relatively low compared to peers.

Capital expenditures have ballooned as the company tries to stay in front of the production boom in the United States. CapEx charges grew to $38.0 billion in 2013, an increase of 23% from the prior year and have nearly doubled over the last five years. Investment spending will likely continue to increase over the next few years but should start to meaningfully add to growth as well. Eventually, capital expenditures should stabilize then slow and investors could see a strong boost to cash flow.

Dividends and Growth

Shares pay a current yield of 3.2%, also the five-year average, though the company has increased the payout ratio to 40% against an average of 31% over the last five years. Chevron has been returning cash to shareholders since 1912 and has increased the dividend for 19 consecutive years.

The dividend has increased by 11.5% annually over the last three years though growth over the last five years has only averaged 9.4% on an annual basis.

The company has not repurchased shares since 2012 when $4.1 billion of stock was bought back but had an aggressive program from 2004 through 2008. When the current cycle of high capital expenditures stabilizes, it is likely that the company will reinstate its buyback program.

Valuation

Shares are currently trading for 12.8 times the last four quarters’ earnings against an industry average of 13.7 times and a 5-year average of 10.3 times earnings for the company.

The shares are slightly closer to fair value on a discounted cash flow basis. I have assumed dividend growth of 9.5% over the next five years as the company continues to favor investment spending against dividend growth. After capital expenditures stabilize or even slow, the company will be able to increase its cash return to shareholders with an assumed 11.5% annual increase.

On strong gains over the last several years, most stocks are looking fairly valued or a little expensive. Chevron is no different with shares fairly valued on a DCF basis and relatively expensive on earnings. The company’s high level of investment on future growth is constructive and new investors can look forward to higher cash flows when large projects start to produce.