This article marks the first of our Dividend Contenders series covering companies that have increased their dividend for 10 or more consecutive years but less than the 25 years needed to be Dividend Aristocrats. It’s a great list for finding up-and-coming companies that could one day graduate to the Aristocrats list.

Caterpillar Investment Highlights

- Massive scale and its brand give Caterpillar survivability during the weakness in heavy machinery demand

- Shares are trading at a 35% discount to the average trailing earnings multiple and a 13% discount to forward earnings

- Strong buy on sustainable 4.3% yield and potential for high annualized return when industry demand returns

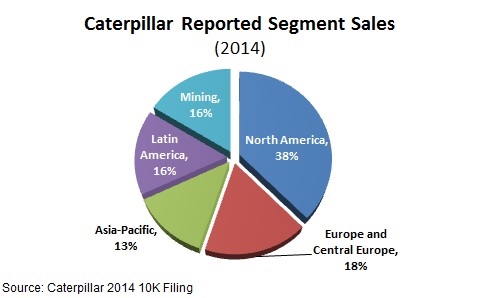

Caterpillar (NYSE: CAT) is the world’s largest mining and construction equipment manufacturer at $43.9 billion. In the construction segment, the company controls nearly a fifth (19%) of the global market and is twice the size of its nearest competitor.

More than a hundred years in operation, the company has a globally-recognized brand and sells equipment at a premium price compared to competitors. Marketing on quality and total cost of ownership has helped it sell in developed markets but has limited growth in emerging markets where purchase price is a big factor.

The company operates Caterpillar Financial Services to help customers finance equipment and sells through a global dealer network. Dealers are local in 131 countries and responsible for maintaining a service and repair network.

The company’s heavy equipment machinery is used primarily in three segments: construction, energy and mining.

The last year has been the proverbial ‘perfect storm’ for Caterpillar as all three segments have weakened. Slowing growth in China means less demand for global commodities and mining, as well as lower construction spending in the world’s second largest economy. Tumbling energy prices in the second half of 2014 are now showing through in reduced capital spending by companies in the sector, reducing demand for heavy machinery.

The entire industrial equipment sector is hurting and I won’t try to call a bottom in the stocks or the demand in the three segments.

But Caterpillar has one of the strongest brands and a low cost of manufacturing due to its scale and dealer network. The company is making the difficult decisions to protect cash flow and emerge stronger. Restructuring expenses are expected to shave $0.30 off of earnings this year but should help drive profitability next year.

Sales to North America could rebound relatively quickly on stabilized energy prices as production levels off heading into 2016. Sales to Europe also look marginally better next year on the region’s continued monetary stimulus.

The demand for heavy equipment is very cyclical and that means the cycle will pick back up eventually.

Caterpillar Stock Fundamentals

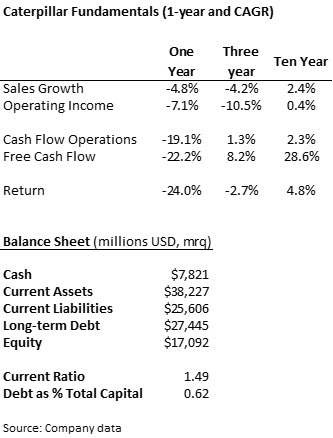

Caterpillar is half-way through its fiscal year so I have used adjusted fundamentals for the table below. Operating income has fallen slightly faster than sales because of fixed costs like administrative expenses. Operating costs should decrease significantly over the next several quarters on the restructuring program.

The company is highly indebted with 62% of the capital structure in long-term debt but shouldn’t face any liquidity problems. Caterpillar has more than $7.8 billion in cash, along with $28 billion in receivables and inventory.

Caterpillar has always been one of the more aggressive spenders on R&D and capital investment within the heavy machinery space. It’s helped the company maintain a wide lead in market share and a strong brand name. The company has cut its capital spending but still invested $3.3 billion in 2014.

Even on an aggressive capital spending plan, Caterpillar still generates nearly $4.0 billion in free cash flow a year. Cash flow is sufficient to continue growing the dividend payment, now at $1.7 billion a year, and to repurchase shares.

Caterpillar Dividend and Growth

Caterpillar prioritizes shareholder cash return and has increased its dividend even in the weak environment. The 4.3% yield is well above the five-year average of 2.6% on the drop in the share price. Against weaker sales and earnings, the payout ratio has increased to 49% from the five-year average of 35% of earnings.

In light of the tough picture for sales, I wouldn’t expect Caterpillar to grow its dividend significantly but it does look like it will be able to maintain a respectable growth rate. The company just increased its quarterly dividend by 10% in July and has grown payments by a compound annual rate of 11% over the last five years.

Dividends have increased for 22 consecutive years and have been paid since 1914.

Caterpillar has been an opportunistic buyer of its own shares, purchasing nearly $3.0 billion over the last year while the stock has been under pressure. In a vote of confidence, management committed to repurchasing $1.5 billion of shares in the third quarter.

Caterpillar Stock Valuation

Shares of Caterpillar trade for 11.7 times trailing earnings of $6.20 per share, well under the five year average multiple of 18.2 times earnings. The discount to the average trading multiple is consistent across the heavy machinery industry and a reflection of uncertainty on sales.

Sales are expected down 11.5% this year and 3% next year to $47.4 billion. Earnings are expected to continue falling to $4.57 per share next year, putting the shares at 15.9 times expected 2016 earnings.

Investors shouldn’t expect much in the way of price appreciation for a year or two but will earn a very good cash return until sales demand improves. When demand does come back to the industry, shares could bounce on higher investor sentiment and rebounding earnings. Shares have fallen to their lowest price in nearly five years and the company has the balance sheet and brand to survive.

Even if it takes five years for the shares to rebound to the 2014 high, investors will realize a 12.7% annualized return with the dividend. I do not expect the weakness to last that long and would recommend the shares as a strong buy.

Do you think CAT is overly exposed to a China slowdown? Sales could get soft if they pull back on building infrastructure to conserve cash.

Fortunately or not, I have a rather long list of favorite stocks! CAT makes the top for a long time already. I like the company, I like the fundamentals and I believe in its growth. Buy, buy, buy! 😉

Cheers,

Mike