ADP Investment Highlights

- ADP is the market leader in an industry with reliable growth, leading to stable cash flows into the future

- An eventual downturn in the U.S. economy will affect shares as companies look to cut costs in HCM and other services

- Shares trade for 30 times trailing earnings, well above the historical average. I recommend avoiding shares until a $73 price target

Automatic Data Processing (NYSE: ADP) (ranked #25 on the top 50 dividend list) is the global leader in human capital management (HCM) with clients in 104 countries. Founded in 1949, the company offers payroll and HR business processing services and controls 9% of the $110 billion global HCM market. The company completed its spin-off of CDK Global late last year which exited it from dealer services and will help it focus on its core HCM business.

ADP has been making a strong shift to cloud services, adding 490,000 clients to its cloud platform from 2012. The company’s mobile application helps provide customer support and services to four million clients in 43 languages.

The company benefits from high switching costs in the industry and a size advantage to service businesses of all sizes. Once a customer contracts for HCM services, it is difficult and costly to switch contractors and ADP enjoys a 91.4% client retention rate.

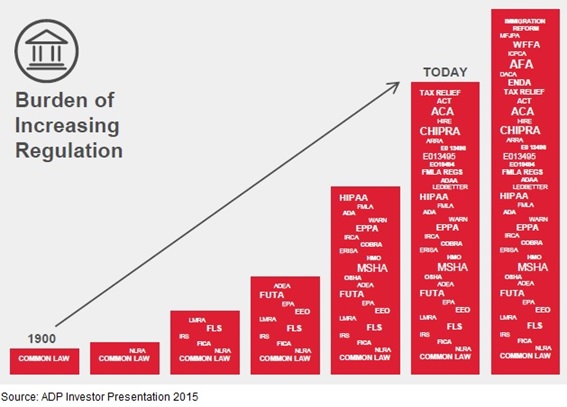

While the industry is fairly mature and only grows at roughly a compound annual rate of 6%, it benefits from an increasing regulatory environment. As regulatory burden increases, payroll and tax compliance becomes more complicated and more companies decide to outsource their HCM functions.

ADP shows in its 2015 investor presentation that less than 20% of mid- and large-size companies report preparedness for regulatory changes from the Affordable Care Act. A third of mid-size businesses report paying non-compliance fees do to problems in in-house HCM and 72% of large companies outsource their payroll for tax compliance.

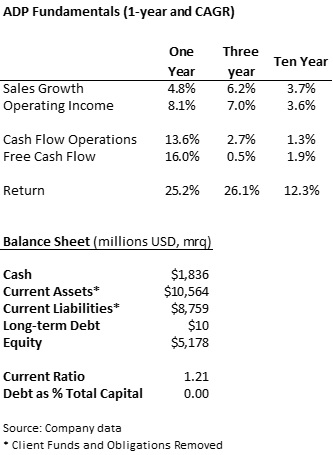

ADP Company Fundamentals

Sales have increased at a CAGR of 6.2% over the last three years, slightly ahead of growth in the HCM market. While sales growth has slipped over the last year, the company has done a good job of controlling costs and operating income has not been affected.

As the economy heads into its sixth year of recovery, a decline in the business cycle could limit share gains. An eventual recession in the U.S. will hit providers of HCM services as companies look to cut costs but ADP should be relatively safe due to economies of scale. The company should be able to cut some costs and drive client retention on lower service costs.

The majority of current assets and liabilities on the balance sheet are “funds held for clients” and “client fund obligations” related to funds held for payroll processing. ADP holds client funds and invests in AAA- or AA-rated bonds with short maturities and books interest on the funds as revenue. The low rate environment over the last few years has hit this segment of revenue and should rebound marginally when interest rates increase in 2016.

ADP has been investing in its cloud and mobile services over the last several years, as well as a heavy pace of acquisitions over the last five years. Cash used for capital investment jumped last year to $85 million, an increase of 30% over the prior year. Still, the company has done a good job of generating cash flow and capital spending should pay off with future growth.

ADP Dividend and Growth

The rapid rise in the share price has lowered the dividend yield to 2.2% from an average of 2.8% over the last five years. Management has increased the payout ratio to 66% of income from the five-year average of 59% but has still not been able to keep the yield from falling.

ADP has paid a dividend since 1974 and has increased it for 39 consecutive years. The per share amount has increased by a compound rate of 7.7% over the last five years. The buyback program was increased significantly over the last two quarters with a cash return of $1.3 billion through share repurchases over the last four quarters.

The company has been relatively consistent with its share repurchase program, reducing the diluted share count by a compound rate of 1% a year over the last five years.

The rapid rise in the shares, along with modest growth in the industry, may limit the cash return over the next year. The company is already paying out two-thirds of income as dividends and buying back shares may not be an inexpensive use of cash.

ADP Stock Valuation

Shares of ADP trade fro 30 times trailing earnings, well above the average multiple of 21.6 times over the last five years. Analysts expect full year 2015 earnings of $2.95 per share on a 10% drop in revenue to $11.0 billion. Sales are expected 7.7% higher next year with a 12.5% increase in earnings to $3.32 per share.

Even if the company can meet expectations for 2016 earnings, the shares would still be trading for 25.8 times earnings. While the company may be better positioned for a U.S. economic downturn through its size and global diversification, a recession will hit sales. I am not saying that a recession is imminent but the shares are priced expensively even on earnings expected years into the future.

I like the long-term outlook for shares of ADP on a greater shift to HCM outsourcing by businesses and high client retention at the company. Cash flow should continue to grow at a stable pace into the future, allowing for a total cash yield between 2% and 4% from the dividend and buyback. This long-term outlook is tempered by a very high valuation in the shares. I would set a target of $73 per share for any positions and avoid the shares until at least $75 per share.

Thanks for the write up Ladders. ADP has been on my radar for years, but I wish I had discovered it 20 years ago. Have a great week buddy

-Bryan

Agreed – wish I had bought ADP years ago. I’ve had it on my watch list for a while – sometimes you just have to pay a higher multiple for quality…