Investment Highlights

- Strong sales in Japan have been partly offset by the developing currency problem experience by many U.S. companies

- A strong brand in a stable industry makes AFLAC a good pick for long-term income and cash return

- The company will launch a new 24-hour pay program through advertising during the Grammys which may help boost shares

American Family Insurance Company (NYSE: AFL) reported earnings last week, meeting bottom-line expectations for $1.30 per share but just missing sales expectations to post $5.51 billion. The stock was up on the following day but I’m glad it didn’t go too much higher because I wanted to get this note out first.

The currency issue continues to be an issue as it has been for many U.S. companies lately but AFLAC has some strong upside over the next year and could be one of the most stable stocks for your long-term dividend portfolio.

Japan has been one of the company’s strengths and AFLAC is the largest provider of cancer policies with more than 15 million contracts. The company has partnered with local carriers, most notably its collaboration with Japan Post Group. Sales in Japan were up 28% in the last quarter on a new cancer policy the company initiated.

Some of upside was offset by a weaker Yen as the company translated profits back into the U.S. dollar but half of the company’s profits are from dollar-denominated policies so the problem shouldn’t weigh too much going forward.

Besides an attractive value for the shares, I really like AFLAC for two reasons. First is general stability in insurance carriers and the potential for upside going forward. Policy holders are not quick to change their carrier once they’ve purchased insurance so client retention and stability in revenue is really the name of the game here. Sales growth may not be as strong as you’ll find in other industries but insurance is one of the most stable for investors.

AFLAC may see revenue growth pick up over the next decade as an aging population, especially in the United States and Japan, leads to more supplemental health policies. While claims will move higher, AFLAC’s strong underwriting management will help drive higher earnings.

I like AFLAC over the other insurance carriers for its strength in Japan and for a program that it is about to launch. The company’s trademark duck will be on the red carpet at the Grammy’s to announce a one-day pay program for claims. Policy holders will be able to fill out their claim on the company’s SmartClaim system with the company promising to process, approve and pay in 24 hours. The program is a strong claim on customer service and could attract a lot of new business.

Fundamentals

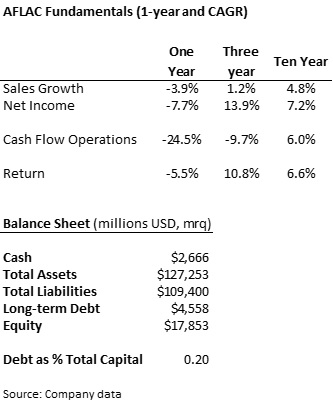

Sales growth has weakened over the last year but has followed a good long-term trend. Despite the slowdown in sales growth, AFLAC has done an excellent job in managing its policy payouts. Income after total benefits and claims has increased to 20% over the last two years, compared to an average of 14% over the five years through 2012.

As a financial company, the balance sheet for AFLAC is a little different from other companies. The company does not have current assets and liabilities since most items are fairly liquid financial instruments. Long-term debt is relatively low at just a fifth of the capital structure and assets cover the firm’s liabilities by a decent margin.

Cash flow from operations sank more than 25% in the last four quarters compared to fiscal 2013, largely as a result of larger non-cash items like payables and income taxes payable in the prior year. The drop does not necessarily worry me since insurance is a relatively liquid business and there is no danger to the company’s financial health.

Dividends and Growth

Shares of AFLAC pay a 2.7% yield, just above the 2.4% average over the last five years. The dividend payout ratio of 23% is also close to the long-term average so I do not see any big changes to policy coming. The company could probably pay out more as dividends but supplements the regular cash return through a buyback program so it evens out.

The company has increased the dividend by 6% annually over the last five years and has increased the dividend for 32 consecutive years. AFLAC has really boosted its stock buyback program over the last four quarters, returning $1.2 billion to investors. Adding in the dividend brings total cash yield to $1.85 billion or about 9% of the company’s market capitalization.

Valuation

Shares of AFLAC are trading for 9.1 times trailing earnings, just below the five-year average of 10.4 times earnings and almost a 30% discount to the 12.9 average multiple on the industry. The new 24-hour pay program could help boost sentiment and the shares could be worth $67 over the next year on an estimated $6.20 in 2015 earnings.

While the stock has underperformed over the last year on weakness in sales, it looks to be a temporary problem and could provide for a good price for new investors. Over the long-term, the shares should provide a stable return along with a strong cash return from dividends. The insurance industry is extremely stable and AFLAC enjoys one of the strongest brands and largest global networks. Over the short-term, shares could get a boost from new programs being launched and continued strength in Japan.

The duck is a strong company that I hold in my IRA account. It has done well. I wouldn’t let myself be persuaded by a new advertising campaign though. Cash (flow) is always King.

I have Aflac in my watch list, but do not plan investing in it yet as it is below my dividend yield threshold 3% and currently have other stocks paying larger yield and rate to invest in.

Been liking this stock for a while already and still not disappointed. Yield might be a little low, but growth is perfect for my investing needs. A buy to me!